For Professional Clients Only

Macro & Market Update

Last month was rich in economic and political developments creating volatility in financial markets. Following the first rate cut of this cycle in September from the US Federal Reserve (Fed) which led investors to extrapolate aggressive further cuts into the future, data in October wrong-footed expectations by showing a stronger economic backdrop than seemed likely in the summer. A good third quarter GDP of 2.8%, strong employment figures accompanied by upward revisions to the disappointing summer numbers, solid retail sales, as well as slightly stronger inflation numbers than anticipated all led to bond markets pricing in one less interest rate cut from the Fed this year and close to 4 fewer cuts for 2025. Movements in bond markets continue to reflect great uncertainty with regards to the direction of travel for the economy and volatility remains well above historical average. The repricing of interest rates in the US was also driven by political developments ahead of the presidential election on 5th November with an increasing expectation of a Trump victory. While investors learnt from his last term not to pay too close attention to his campaign promises, it seems reasonable to expect that his second mandate would see increased tariffs on foreign trade and tax cuts, both of which would be inflationary and make it harder for the Fed to cut rates aggressively. The election campaign has been long and painful in many respects, and with both candidates still neck-and-neck in the polls, one can only hope that 5th November will provide relief to financial markets as the long uncertainty is lifted. Unfortunately, it is possible that the next president will not be known for some time if recounts are necessary, and results are contested.

In the UK, some uncertainty was lifted after the Budget announcement from Chancellor Reeves. While a seemingly messy and uncoordinated pre-Budget campaign by the Labour government led to anxiety ahead 29th October, the Budget itself was broadly as expected with higher taxes, higher spending and higher borrowing. The main surprise was the scale of the borrowing required over the next few years, which initially led to higher bond yields but the worst case scenario of a repeat of the Truss “mini-budget” of 2022 appears to have been avoided. Investors will want evidence that higher taxes and borrowing will lead to improved services and productivity quickly and this will require some luck but, in this early stage post the announcement, the government’s aim to balance the budget and invest for growth are laudable. Like in the US, the bond market in the UK was volatile as concerns about higher borrowing at the end of the month post-Budget were preceded by a surprisingly low inflation figure of 1.7% earlier in the month. It was the first time inflation came out below the stated Bank of England’s target of 2% since April 2021 and had led to expectations of accelerated rate cuts over the coming months.

Elsewhere, the European Central Bank cut interest rates by another 0.25% as growth, particularly in Germany and France, continues to disappoint and inflation is weakening faster than previously forecast. Like in France before the summer, the new Japanese prime minister appears to have lost his gamble to call snap elections and his party lost its majority, raising questions about a future government. Finally, despite a cut to its lending rate in an effort to restart mortgage demand, the Chinese government is yet to provide substantial details about the size of the raft of stimulus measures they announced in September, leaving investors in limbo.

This busy macroeconomic and political news flow led global bond and equity markets in the red. In commodities, gold benefitted from the uncertainty and concerns on both sides of the Atlantic about rising borrowing and debt. Oil was volatile after an escalation of the conflict between Israel and Iran. Last but not least, the US dollar benefitted from the relatively stronger growth in the US, political anxiety and geopolitical tensions. It strengthened by 3.7% versus sterling.

Fund Performance

Wise Multi-Asset Growth

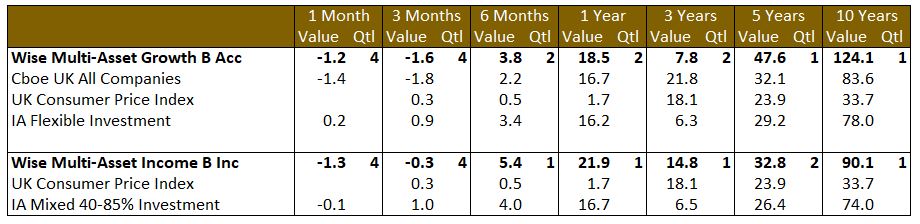

In October, the IFSL Wise Multi-Asset Growth Fund was down 1.2%, ahead of the CBOE UK All Companies Index (-1.4%) but behind its peer group, the IA Flexible Investment Sector (+0.2%).

Our biggest contributor to performance was the Jupiter Gold and Silver Fund up about 11% thanks to the strong move in gold we mentioned earlier. The fund is up close to 70% since the end of February, although this only brings it back to the level it was trading at post-Covid. After such a strong move, we have been active in locking in some profits, but we remain invested because the gold mining companies the fund holds remain cheap relative to their history and, more importantly, relative to the price of gold, so they have yet to fully reflect the strength in the metal price. The gold mining sector is tiny in market capitalization terms (all the listed gold miners globally represent about a tenth of the size of Apple) so are ignored by many fund managers, but marginal flows into their stocks are enough to create significant returns.

Investment trusts, in general, detracted to performance as discounts widened over the month driven by a weaker equity market in the UK ahead of the Budget, particularly affecting small and medium-sized companies. Compounding the negative effect of wider discounts, the net asset values of our UK equity funds also fell.

Wise Multi-Asset Income

In October, the IFSL Wise Multi-Asset Income Fund fell 1.3%, behind its peer group, the IA Mixed Investment 40-85% Sector which fell 0.1%. Performance was negatively impacted over the month by domestically exposed assets, notably UK smaller company equities, property and our direct financials holdings. Uncertainty around the budget and higher bond yields put pressure on these assets, somewhat reversing their recent strength. Despite a backdrop of rising yields, our bond allocation was flat over the month, helped by the relatively short-dated life of the underlying bonds holdings and the floating rate exposure of certain funds as prices are less sensitive to interest rate moves as their coupons (semi-annual payments) adjust as interest rates move up and down. News flow from portfolio holdings was limited over the month. Helical announced it now has three property schemes underway and that it is on course to deliver over 450,000 sq ft of best in class office space by 2026. It has submitted a student accommodation planning application and is making progress on letting up empty space. ICG Enterprise provided an encouraging net asset value for the first half, with portfolio companies continuing to deliver strong revenue and earnings growth over the last 12 months.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Over the month, we continued to be diligent in booking profits in strong performers as a way of protecting the portfolio against downside volatility and recycling gains into new ideas. The trims included the Jupiter Gold and Silver Fund mentioned above, as well as Polar Capital Financials Trust, Pantheon International, and open-ended funds in the UK (Man GLG Undervalued Assets and JO Hambro UK Equity Income which was exited fully). We used these proceeds to instigate a new position in the Premier Miton Strategic Monthly Income Bond Fund. This is a differentiated, high quality corporate bond fund where sensitivity to interest rates is kept minimal and trading is active as opposed to the buy-and-hold strategies of many other competitors.

Wise Multi-Asset Income

We reduced our holding in abrdn Property Income following the announcement of the impending disposal of the majority of its assets. We partially used the proceeds to initiate a position in the Premier Miton Strategic Monthly Income Bond Fund. This is a differentiated, high quality corporate bond fund where duration in kept very short and trading is active as opposed to the buy and hold strategies of many other competitors.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.