For Professional Clients Only

Macro & Market Update

Financial markets were mixed in June, catching some breath after strong performance since Q4 last year and impacted by political uncertainty which added to the usual monthly cycle of economic data releases and central banks meetings. Starting with the latter, the European Central Bank (ECB) cut interest rates for the first time in 5 years. This was expected by investors, however, given the downtrend in inflation in the Eurozone and the precarious growth. The ECB will remain data dependent from here and, with inflation surprising slightly on the upside last month, only two more rate cuts are priced in for the rest of the year. In the US, the Federal Reserve (Fed) did not make any change to its monetary policy, despite inflation falling below consensus expectations and despite signs of a slowdown in consumer spending which has helped US growth beat expectations post-Covid. Moreover, the Fed disappointed markets by updating its interest rate cuts forecast from three this year down to one. The market continues to price in two rate cuts for the rest of the year though, illustrating how hard data remains to predict. The UK won the race to be the first to bring inflation back down to its official target of 2%, an achievement after three years above that level, reaching highs of 11.1% in 2022. It is too early to celebrate, however, because services inflation remains stubbornly high and core inflation (inflation stripped out of the volatile food and energy prices which have come down recently) is still at 3.5%. Acknowledging the persistent strong wage growth, the Bank of England refrained from cutting rates and investors expect two rate cuts to come later this year to help support growth which came out flat last month.

Rather than the above, however, it was political developments that dominated headlines last month in one of the busiest such months one can remember on that front. Starting with emerging markets, election results in India, Mexico and South Africa all confounded expectations, creating market volatility. Bar rare exceptions, however, political changes and surprises tend to be rapidly absorbed by financial markets and have little lasting impact on price performance. Uncertainty is never appreciated by investors though, so volatility can ensue. In developed markets, the European elections, as expected, delivered major gains for far-right forces, despite the centre-right cementing its grip on the Parliament. The main impact of these elections so far, however, was felt at the national rather than European level with President Macron of France calling snap elections to try and counter the rise of the far-right domestically. At the time of writing, a day after the results of the first of two voting rounds, that bet appears to have backfired and France is now facing either political paralysis or a change of direction. This uncertainty is of concern for markets, which worry about the already high level of debt in France and likely clashes between a new government and their European counterparts. In the UK, a change of direction also looks likely as we reach the final stages of the General Election campaign. This change is well anticipated by investors so is unlikely to create much surprise. Finally, in the US, while the elections are still 4 months away, a poor performance from Joe Biden during its televised debate with Donald Trump raises increasing questions about his age and might lead some in his party to try and engineer a last-minute change in candidate.

In the context above, emerging markets performed well, helped by India which shook off an initial drop of more than 8% after the announcement of a loss of absolute majority by President Modi to end the month 7% higher. Developed equity markets were mixed with the UK lagging, Europe flat and the US delivering good returns, albeit skewed by Nvidia, the Artificial Intelligence chip designer, up more than 13% to reach a market capitalization above $3tr, an exclusive club with only Apple and Microsoft as other members globally. Bond markets oscillated between the positive prospects of future interest rate cuts and fears about ballooning debt and budget deficits. Finally, commodities were mixed too with industrial metals giving back some of their recent gains and oil rebounding after an announcement of production cuts by the largest global producers.

Fund Performance

Wise Multi-Asset Growth

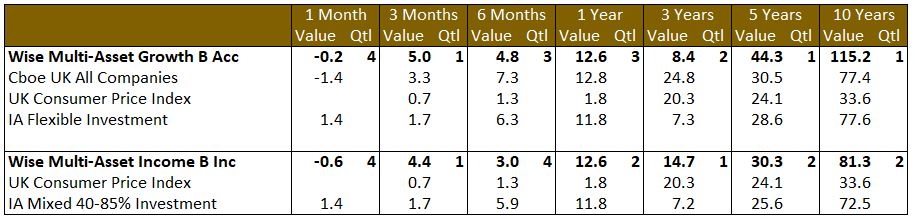

In June, the IFSL Wise Multi-Asset Growth Fund was down 0.2%, ahead of the CBOE UK All Companies Index (-1.4%) but behind its peer group, the IA Flexible Investment Sector (+1.4%). At the half-year mark, the Fund is up 4.8% compared with +7.3% for the CBOE UK All Companies Index and +6.3% for the IA Flexible Investment Sector. Our strongest contributors over the month were in the healthcare sector with all three of our holdings, RTW Biotech Opportunities, Worldwide Healthcare and International Biotechnology benefitting from the continued rebound in biotechnology names, helped by cheap valuations, a return of IPOs (when private companies raise capital via public markets), ongoing acquisitions at large premiums and exciting innovations. RTW Biotech Opportunities illustrated these drivers well last month as one of its holdings was acquired at a 186% premium to its most recent valuation, and its top holding surged more than 40% on the announcement of positive clinical results. Similar positive announcements were also made in the International Biotechnology portfolio. This is a sector we continue to be excited about, reflecting its 11.5% weight in the Fund.

The largest detractor was Pantheon International which saw its discount widen without any relevant changes to its Net Asset Value. BlackRock World Mining also struggled given the weakness in industrial metals mentioned earlier.

Wise Multi-Asset Income

In June, the IFSL Wise Multi-Asset Income Fund fell 0.6%, behind the IA Mixed Investment 40-85% Sector, which rose 1.4%. Our specialist financials holdings detracted most from performance led by life insurer, Legal & General, which provided a disappointing strategy update during the month. Whilst forecasting earnings growth of 6-9% out to 2027 and committing to a £200m share buyback, this comes at the expense of dividend growth which is set to grow at a reduced rate of 2% per annum. The total yield of 10% (share buyback and ordinary dividend) remains attractive but also reflects slower capital generation from the business than expected. Paragon announced strong results, ahead of expectations, with positive momentum in its buy-to-let lending book leading to upgraded full year forecasts and a further £50m share buyback. The shares were flat following strong recent performance. Reflecting the broader commodity market weakness, both Blackrock Energy and Resources and Blackrock World Mining were weak. Our strongest performers were within our infrastructure holdings where recent company updates continue to highlight the value that their discounts to net asset value represent. Pantheon Infrastructure published a strong quarterly Net Asset Value (NAV), delivering a 4.1% total return over the period driven by notable valuation uplifts at a number of portfolio holdings. GCP Infrastructure announced half-year results and demonstrated positive progress in its allocation policy to recycle capital, reduce debt and buy back shares at a significant discount. Another notably strong performer was the International Biotechnology Trust where cheap valuations within the sector have been supported by continued mergers & acquisitions at significant premiums as larger pharmaceutical companies seek to replenish their pipelines of future drugs.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Over the month, we exited our position in VPC Specialty Lending Investments, a private lender to predominantly US start-ups. The trust is in wind-down with a commitment to return capital to shareholders as soon as practical but we think this process will take a long time given the illiquidity of its investments, thus presenting a big opportunity cost if we wait for cash to be returned to us. We also reduced our positions in Templeton Emerging Markets, Caledonia Investments, TwentyFour Strategic Income Fund and Jupiter Gold & Silver, raising some cash ready to be deployed for new opportunities.

Wise Multi-Asset Income

Over the month, we further reduced our exposure to Legal & General, took some profits in Aberforth Smaller Companies and Polar Capital Global Financials which has performed strongly in recent months. We added to our holdings in GCP Infrastructure and Pantheon Infrastructure where we believe the discounts to NAV and implied future returns from their portfolios offer compelling value.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.