For Professional Clients Only

Macro & Market Update

Financial markets ended the year with a bang, recording strong gains in December after what had already been an excellent month in November. This allowed to salvage a difficult year for most markets until then, highly volatile and, often, returns-free. Global equities, in sterling, were up more than 17% for 2023, thanks to an 11% push in the final two months of the year alone. Meanwhile, a global index of government and corporate bonds managed to end the year flat in sterling terms, despite being down 4% in the year-to-October.

While we mentioned in last month’s commentary that the rebound then was driven by a combination of better economic data, attractive valuations and extreme negative sentiment, it was mainly an unexpected pivot from the US central bank that pushed prices higher in December. Leading up to the central bank meeting in mid-December, data were pointing to a continued slowdown in inflation in the US, as well as in the UK and Eurozone, at a faster rate than anticipated. However, employment figures in the US remained strong, fuelling investors’ expectations -ours included- that central bankers would push back on the narrative that, not only interest rates had peaked but also that interest rates cuts were in the pipeline for 2024. We mentioned in last month’s commentary that “The worst outcome for them [central bankers] would be these encouraging early signs of improvement to be crushed by overexuberant investors”. Given his cautious approach until the December meeting, it was thus very surprising that Jay Powell (US central bank chairman) delivered a resolutely more market friendly message, embracing the peak rates narrative and entertaining the idea of more rate cuts than previously expected by the committee in 2024 and 2025 (a stance that the UK and Eurozone central banks refused to take as they stuck to their higher-for-longer message). Investors could not have asked for a better Christmas present and thus proceeded to add risk to their portfolios. We suspect Mr Powell misjudged the propensity of investors to swing to overexuberance and will have to spend the next few weeks tweaking his message to avoid undoing all the hard work central banks have done over the past few months, but only time will tell. For now, this unexpected twist benefitted most asset classes, even UK equities which were on par with US equities in December. That said, they still lagged by more than 18% for the year in local currency terms (a like-for-like performance comparison before the effects of exchange rates conversions). This discrepancy in performance, despite the broad-based end of year rebound for most, was definitely a feature of 2023 with global equities led higher by US equities, themselves mostly driven by a very small number of large technology-related individual names. Without exposure to those few companies, investors recorded mediocre returns at best.

Aside from equities and bonds, commodities’ returns were mixed. The energy complex was weaker on the month (and the year) after what appeared to be discord within the group of the largest global oil producers, while gold reached an all-time high boosted by the prospect of future interest rate cuts.

Fund Performance

Wise Multi-Asset Growth

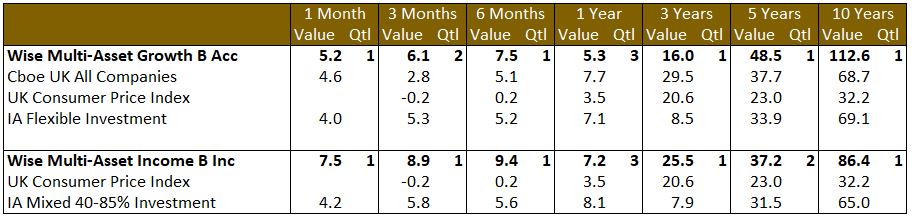

In December, the TB Wise Multi-Asset Growth Fund was up 5.2%, ahead of both the CBOE UK All Companies Index (+4.6%) and its peer group, the IA Flexible Investment Sector (+4%). Our annual performance, however, at 5.3%, failed to beat our UK equity benchmark and our peer group, but was ahead of our inflation benchmark. The Fund remains ahead of both its target benchmarks and its comparator peer group over our 5-year time horizon.

Our best contributors for the month were found in healthcare (International Biotechnology Trust, RTW Biotech Opportunities), a sector we have consistently been adding to over the year. Two of our largest holdings, AVI Global and Oakley Capital Investments, also performed strongly. Finally, as an illustration of how well value investing performed in December, other notable strong contributors were AVI Japan Opportunity and TR Property.

There was no notable detractor to performance.

Wise Multi-Asset Income

In December, the TB Wise Multi-Asset Income Fund rose 7.5%, ahead of the IA Mixed Investment 40-85% Sector, which rose 4.2%. This strong finish to the year was driven by many of the same sectors as last month. Our financials holdings performed strongly as investors welcomed the prospect of easing monetary policy. Paragon Banking Group, a buy-to-let lender, was notably strong following an excellent set of full year results delivering record profits, strong dividend growth and the prospect of further share buy backs. Our property holdings rose strongly once again as the pressure from higher rates eased. Abrdn Property Income highlighted the potential rental growth within their portfolio and announced positive increased rents achieved within their industrial portfolio as well as a new letting of a refurbished asset. Starwood European Real Estate Finance announced the repayment of a property loan enabling a further capital distribution to shareholders as part of the strategy to wind the company down. Our infrastructure holdings performed well as investors were attracted the high inflation-linked yields available across the sector at a time when the yields from government bonds are now falling. International Public Partnerships announced the disposal of four investments at a modest premium to the latest net asset value, highlighting the extent to which the current discount undervalues the company whilst enabling the group to pay down their expensive debt facility and undertake a buy back of shares. There was broad strength across our equity and commodity holdings, driven on the whole by strong underlying net asset value performance rather than discount narrowing among our investment trust positions. Aberforth Smaller Companies, Middlefield Canadian Income and International Biotech were notably strong.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Portfolio activity was limited to some profit taking in AVI Global and Oakley Capital Investments during the month. Despite the better mood from investors into the year-end, it is important to remember that central bankers have had a tendency of taking market participants by surprise recently, probably not by design but as a result of the confusing and unpredictable economic environment we are in. As such, until backed up by actual interest rate cuts, one should treat their talk as cheap and proceed with caution.

After a tricky year, the rebound in our performance since the low at the end of October and our outperformance relative to our benchmarks since then give us comfort about the degree of value that is embedded in the Fund. Although some of our holdings proved painful at times and did not perform as anticipated, the fact that the Fund is up 11.5% since the October low relative to the CBOE UK All Companies Index up 7.9% shows that the market may be starting to focus on oversold assets again, at least in the short term. We continue to believe that this is the right investment approach to follow so are not starting the New Year any differently than we have done since inception of this Fund in 2004, with a focus on quality assets that are undervalued and with a disciplined portfolio management.

Wise Multi-Asset Income

Whilst investor expectations for December 2024 interest rates are broadly similar at the end of the year as they were at the start, there has been a strong divergence of performance within the fund’s holdings over that period. Infrastructure and property have been particularly weak and we topped up our exposure to both sectors during the month. We trimmed holdings which have performed strongly, such as Paragon, TwentyFour Strategic Income and Aberforth Smaller Companies whilst increasing exposure to weaker performing positions, such as our commodity holdings, International Biotechnology and Middlefield Canadian Income. We exited our holding in Jupiter Income on the announcement of a change in manager as well as Fulcrum Income, a more defensive holding, in order to maintain the balance of risk within the fund.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the WS Wise Funds, including risk warnings, are published in the WS Wise Funds Prospectus, the WS Wise Supplementary Information Document (SID) and the WS Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds. The WS Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years could be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. Waystone Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.