For Professional Clients Only

Macro & Market Update

Like last month, investors remained focused on inflation in December. While costs of production have steadily been rising at a slower pace for a few months, the early signs of a peak in consumer price inflation only appeared a month ago. The latest data released in December indicated that the worst might indeed be behind us with US inflation being weaker for the second month in a row, while UK inflation also dropped. Thanks to the easing of global supply chain bottlenecks, lower energy prices than earlier in the year and the year-on-year comparison making it harder and harder for inflation to keep rising at breakneck speed, lower inflation is not surprising. The risk, however, is how embedded core inflation (i.e. inflation stripped out of the more volatile energy and food prices) will be, whereby, for example, employees demand wage rises because they expect inflation to persist, pushing all costs to increase in a vicious inflationary circle. This represents central bankers’ biggest fear and why they have been so keen to aggressively quash inflation over the past few months, rising rates at an unprecedented speed. The signs of a peak in inflation allowed central banks in the US, UK and Europe to reduce their pace of interest rates hikes from 0.75% down to 0.50% in December. They were very prompt, however, to remind investors that we might still be a long way from a pause in financial conditions tightening. After the pain already inflicted to their relative economies this year, they are keen for it not to be for nothing if they stop rising rates too soon and let inflation creep back in. The strong employment numbers across those three regions last month (a sign that wage growth will persist) thus dampened investors’ excitement in anticipation of further rate rises on the horizon.

The other notable event of the month was equally as ambiguous as the inflation data above. As we mentioned in our previous commentary, the Chinese government gave signs in November that it was considering relaxing its strict zero-Covid policy, first by relaxing the quarantine rules for inbound passengers and then by easing lockdown rules on a localised basis. Since then, measures were further relaxed with domestic travel restrictions lifted, quarantine at home instead of dedicated centres and the abolition of quarantine altogether for inbound passengers. While the end of the zero-Covid policy which had such a negative impact on the Chinese economy and its citizens is welcome, the speed at which it is implemented raises serious concerns for a population that has only had limited exposure to the virus, only has access to less efficient domestic vaccines and which has a relatively low vaccination rate, particularly for the third booster amongst the older people. The official daily briefing on covid cases and deaths has been suspended since Christmas Eve, so it will be hard to monitor how the situation evolves but, at the time of writing, an increasing number of countries have implemented testing and isolation measures for passengers coming from China, mainly by fear that the rapid spread of the virus might lead to new variants against which existing vaccines are less efficient.

In terms of market performance, the mixed messages above prevented the strong momentum from November to persist into the year-end. Amongst the main asset classes, US equities were one of the worst performers, dragged lower by the more growth-oriented names, like the technology sector. This took them down 18% for the year in US dollar terms, although the strength of the dollar relative to sterling brought its fall to 8% for British investors. Japanese equities also had a poor month after the Bank of Japan gave signs that it too will tighten financial conditions after months of going against the trend in other developed countries. Chinese equities were flat but, at least, managed to hold onto the strong gains from the previous month. Finally, UK equities fell slightly but ended 2022 with a rare positive return, in sharp contrast with other asset classes, bar commodities.

Fund Performance

Wise Multi-Asset Growth

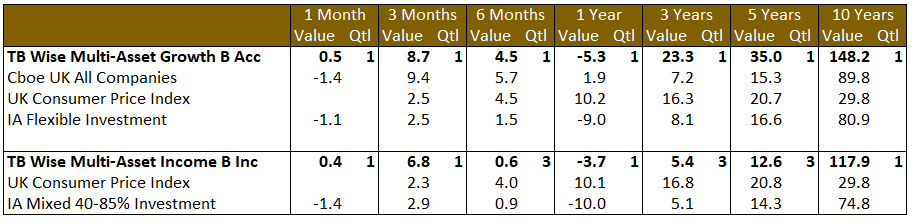

In December, the TB Wise Multi-Asset Growth fund was up 0.5%, ahead of both the CBOE UK All Companies Index (-1.4%) and the IA Flexible Investment sector (-1.1%). For what has been a very difficult year for investing with global equities and bonds recording one of their worst combined performances ever, we are disappointed to have delivered a negative performance (-5.3%) but are somewhat comforted by the fact we outperformed more than 75% of our peers in the IA Flexible Investment sector. Three full years after the start of the Covid pandemic, with returns of 23.3%, the fund outperformed 95% of its peers, beating both its equity and its inflation benchmarks.

Our top contributors were found in Asia last month where, despite the subdued performance in China we described above, the managers of both the Fidelity China Special Situations and Fidelity Asian Values trusts added value and were helped by a tightening of their trusts discounts. Our position in gold via the Jupiter Gold & Silver Fund also performed well. Finally, International Biotechnology Trust benefitted from its largest holding being acquired at a 48% premium. This continues to illustrate some of the latent value in our managers’ portfolio, be they in listed equities (like in this case and our smaller companies managers) or private equity.

Pantheon International was our largest detractor, driven by a widening of its discount on no news. At 45%, it remains off its recent level of 52% discount, but still presents incredible value nonetheless.

Wise Multi-Asset Income

In December, the TB Wise Multi-Asset Income fund was up 0.4%, ahead of the IA Mixed 40-85% Investment sector which fell 1.4%. For what has been a very difficult year for investing with global equities and bonds recording one of their worst combined performances ever, we are disappointed to have delivered a negative performance (-3.7%) but are somewhat comforted by the fact we outperformed more than 90% of our peers in the IA Mixed 40-85% Investment sector.

Global equity markets retraced some of their strength in the last two months as enthusiasm that inflation was under control and interest rates were nearing a peak was tempered. US equity markets were weakest, compounded by a weaker dollar, whilst Chinese equity markets welcomed the news around zero-Covid. Industrial metals, such as copper and iron ore, also rose during the month reflecting hopes of stronger economic growth in China from relaxed Covid restrictions, a stabilization in the real estate sector as well as increased infrastructure stimulus. Copper rose 2% over the month whilst Iron Ore prices were up close to 20%. The strongest performance within the fund came from our financial holdings. Paragon, predominantly a mortgage lender to professional buy-to-let investors announced a strong set of full-year results, and the share rose 20% accordingly. Despite a tougher economic backdrop in the UK, the company continues to grow its loan book whilst its balance-sheet is robust, both in terms of the capital its holds and the provisions it has made against its loan book to reflect current economic uncertainty. Numis was another strong performer over the month which reflects the cheapness of its valuation rather the strength of the results it announced. This is a cyclical business and the current outlook for capital market deal volumes remaining subdued. Nonetheless, its market position remains strong and it is well positioned when markets turn in its favour. Our property holdings remain volatile, with abrdn Property Income rising 14% on the back of a strong lettings update and news around its financing, whereas Ediston Property fell 7% on its full year results. We believe the company is extremely well positioned to take advantage of current dislocation in the property market, having sold out of all of its non-retail warehouse assets earlier in the year. Whilst the net asset value could fall further at the year end, we believe this is reflected in the 37% discount the shares trade on and its 8% dividend yield is highly attractive. Another area of strength over the month was International Biotechnology Trust, which benefitted from its largest holding, Horizon Therapeutics, being acquired by Amgen at a 48% premium. This theme of large pharma buying biotech companies to replenish pipelines is a theme we expect to continue.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Having added some risk in the portfolio in November and being wary of market movements driven by thin liquidity into year-end, we kept our trading activity to a minimum in December. We only trimmed another tranche of GCP Infrastructure, preferring using cash as a defensive position rather than an attractive yet sometimes volatile bond infrastructure trust to protect our portfolio. We ended the month with 2.4% in cash.

Wise Multi-Asset Income

Over the month, we topped up our holdings in GCP Infrastructure, CT Private Equity and Ediston Property given recent weakness and wide discounts to net asset values.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.