For Professional Clients Only

Macro & Market Update

After the tumultuous past few months, it was a relief to be able to put UK politics aside in November. Chancellor Jeremy Hunt delivered an Autumn statement which, despite painting a bleak outlook for the UK economy and announcing belt-tightening measures across the spectrum, had been well communicated in advance and thus proved a relatively non-event for financial markets, in sharp contrast with his predecessor “mini-budget” in September. Instead, investors’ sentiment was boosted by a series of positive incremental developments.

Firstly, the mid-term elections in the US confounded pollsters’ predictions and the anticipated “Red Wave” which would have seen Republicans take control of both the House of Representatives and the Senate, helped by a number of Trump-supported candidates. In practice, Democrats lost the House but by a much narrower margin than expected, while the Senate will marginally stay in their control. This political picture is a grim one in terms of what the Biden administration will be able to achieve before the next presidential election in 2 years’ time, but markets took comfort in the fact that the results depicted a weakened Donald Trump and reduced uncertainty for the next couple of years. A gridlock political landscape is often positive for financial assets as corporate management and investors can focus on managing their businesses without worrying about new laws perturbing the status quo.

Secondly, data points are increasingly pointing out to a weakening in inflationary pressures. The figure investors took the most at heart was the US Consumer Price Index (CPI) which came in below expectations at 7.7% year-on-year. This led to reinforced expectations that the US Federal Reserve will slow its pace of interest rates hikes. Before the release of that number, all three major central banks (US, Eurozone, UK) hiked rates by 0.75%. Expectations are now for the next moves in December to be 0.50%. While this in no way represents a “pivot” by which central banks would pause or reverse their financial tightening, financial markets tend to anticipate moves far in advance and focus on changes of direction as opposed to absolute numbers. The next round of inflation data in December will show whether we are likely to be past peak inflation or not but, if confirmed, markets should start pricing in peak interest rates over the coming months, which should provide valuations support.

Finally, developments in China also helped push so-called risk assets strongly higher in November. With the Party Congress behind it, the government has increasingly given out signals that it is considering a loosening of its strict Covid restrictions. Its travel rules were relaxed early in the month by shortening quarantines for inbound travellers for example and, towards the end of the month, an increasing number of localised lockdowns were eased despite a surge in case numbers. Unusually for China, protests against lockdown measures started building momentum and seemed to trigger a change of tone from authorities with regards to the pandemic containment. Given how damaging the impact of those zero-Covid measures have been on the Chinese economy for more than two years, any loosening over the next few months would help boost domestic and global growth.

The above helped propel all equity markets sharply higher, led by China and emerging markets. For the latter, the weakness in the US Dollar was also a driving factor as, historically, emerging markets have tended to perform better when the Dollar falls. The softening in inflation drove bonds higher since inflation erodes the value of fixed interest instruments. Finally, commodities were mixed with energy weakening (a driving factor in the weaker inflation) but industrial metals had a strong month on hope of China re-opening soon.

Fund Performance

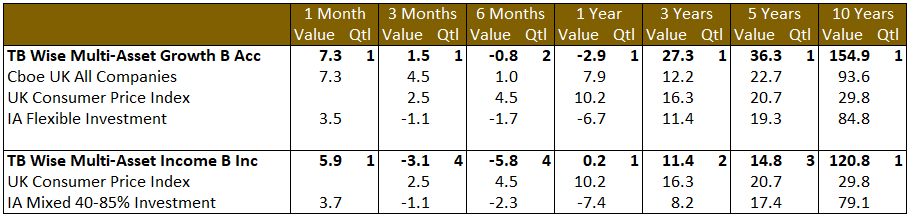

Wise Multi-Asset Growth

In November, the TB Wise Multi-Asset Growth fund was up 7.3%, in line with the CBOE UK All Companies Index and ahead of the IA Flexible Investment sector (+3.5%). As we mentioned over the past few months, the rebound in risk appetite tends to support a tightening of our investment trusts’ discounts, thus boosting the return of the underlying assets in those trusts. Last month was no exception and the most striking example came from our top contributor, Caledonia Investments whose discount moved from close to 40% at the end of October to 20%. While the company reported strong half-year results at the end of the month, the move in the share price outweighed the results dramatically and illustrates how powerful the valuation pull can be once extreme levels are reached. We trimmed our position on the back of that move as our valuation discipline dictates but, even with the recent tightening, the discount is only back to its average level as opposed to being expensive. We also believe the underlying assets of listed and private companies remain well positioned for the upcoming months with the latter displaying strong operational performance despite challenging times.

Another top contributor was Odyssean which benefitted from the strength in UK smaller companies (like Aberforth Smaller Companies) but, mostly, from the news of takeover activities on two of its portfolio holdings. This is a testament of the value that can be found in small companies in general and in the UK in particular (a theme common to all our smaller companies managers), but also a vindication of the managers’ concentrated and engaged stock selection, which has translated into five bid approaches in the portfolio over the past 12 months alone out of a portfolio of less than 20 holdings.

The detractors were limited during the month.

Wise Multi-Asset Income

In November, the TB Wise Multi-Asset Income fund rose strongly, up 5.9% and ahead of the IA Mixed 40-85% Investment sector which rose 3.7%. Against a backdrop of improved investor sentiment globally and the receding market panic that accompanied the mini-budget in September, it was our direct equity holdings in the financials sector as well as our UK equity and global equity funds that were the strongest performers during the period. Legal & General updated the market with a positive statement indicating positive momentum has continued into the second half of the year, reassured over its exposure to Liability Driven Pension Investments (LDI), whilst painting a positive picture for its solvency position and the outlook for its core pension buyout market. Chesnara, Paragon and Provident Financial also rebounded from recent weakness. Despite the gloomy outlook for profitability for many UK companies, which face weaker consumer demand, ongoing supply chain issues and rising cost and wage inflation, our UK equity funds were some of the strongest performers over the month. The belief that the new Chancellor represents a sensible helm on the tiller, that expectations for the direction for interest rates were overly cautious combined with historically low valuations proved a powerful driver for domestic equities. Aberforth Smaller Companies, Man GLG Income, Fidelity Special Values and Temple Bar all rose strongly during the month. The improved global sentiment help lift our international equity fund holdings, such as Schroder Global Equity Income and International Biotech whilst the hopes around a lifting of Chinese Covid restrictions were particularly helpful for our equity funds with emerging market exposure, such as Aberdeen Asian Income, as well as our commodity exposed funds.

We have previously highlighted the historically high discounts on offer within the Private Equity space. Discounts of over 40% suggest investors are concerned either about the robustness of the valuations of the underlying holdings or the liquidity outlook for the trusts given levels of the indebtedness and future funding commitments. On both counts our holding in this space, CT Private Equity, provided tangible reassurance during the month. Firstly, the company continued its strong recent track record of realisations that prove up the conservativeness of its valuation process. The company announced the disposal of San Siro, an Italian funeral business, at a 200% premium to its June valuation. At the same time, the group also announced historically low levels of gearing and funding commitments, which position them well to invest at attractive levels in 2023.

One area that lagged in performance terms was our property holdings. Despite relative upbeat comments from the sector around rental demand, the sector has not recovered from the falls suffered in the immediate aftermath of the mini-budget at which point government bond yields spiked higher. It is notable, therefore, that as at the end of November UK 10-year government bond yields have now returned to levels seen before the mini budget whilst on average our property holdings remain 15% lower.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Income

During the month we added to our UK equity fund positions funding these purchases through the disposal of John Laing Environmental and deploying some of our cash.

Wise Multi-Asset Growth

Starting to sense a shift in central banks stances and investors’ sentiment, combined with some extreme negative positioning and attractive valuations, we added some risk to the portfolio early in the month via UK smaller companies (Aberforth Smaller Companies), private equity (Pantheon International) and healthcare (Worldwide Healthcare). Those purchases were financed by reductions in the more defensive GCP Infrastructure and Pacific G10 Macro Rates. At the end of the month, as previously mentioned, we also took some profits in Caledonia Investments and topped-up TR Property on weakness. We ended the month with 2.2% in cash.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.