Wise Multi-Asset Growth

Fund Ratings

Investment Objective

The investment objective of the Fund is to provide capital growth over Rolling Periods of 5 years in excess of the Cboe UK All Companies Index and in line with or in excess of the Consumer Price Index, in each case after charges.

Fund Attributes

- Aims to provide long term capital growth (over 5 year rolling periods) ahead of the Cboe UK All Companies Index and inflation.

- Specialised focus on investment trusts across asset classes.

- Adopts a value bias investment approach.

- Focus on high-quality funds and investment trusts investing in out-of- favour areas.

- Preference for fund managers with a disciplined, easy-to-understand investment process.

Investor Profile

- Seek capital growth over a long time frame.

- Accept the risks associated with the volatile nature of an adventurous multi-asset investment.

- Plan to hold their investment for the long term, 5 years or more.

Key Details

| Target Benchmark | Cboe UK All Companies, UK CPI |

|---|---|

| Comparator Benchmark (Sector) | IA Flexible Investment |

| Launch date | 1st April 2004 |

| Fund value | 64.8 million |

| Holdings | 40 |

| Valuation time | 12pm |

- Past performance is not a guide to the future

- Data as at 30th November 2025

Investment Portfolio - November 2025

- Past performance is not a guide to the future

- Data as at 30th November 2025

- Wise Funds Ltd are delighted that our Wise Multi-Asset Growth Fund was announced as winner of the Flexible Investment Category at the prestigious Investment Week’s Fund Manager of the Year awards.

Share Class Information

| | B Acc (Clean) | W Acc (Institutional) |

|---|---|---|

| Sedol Codes | 3427253 | BD386X6 |

| ISIN Codes | GB0034272533 | GB00BD386X65 |

| Minimum Lump Sum | £1,000 | £100 million |

| Initial Charge | 0% | 0% |

| IFA Legacy Trail Commission | Nil | Nil |

| Investment Management Fee | 0.75% | 0.50% |

| Operational Costs | 0.14% | 0.14% |

| Fund Management Costs | 0.22% | 0.22% |

| Ongoing Charges Figure 12 | 1.11% | 0.86% |

All performance is still quoted net of fees.

- The Ongoing Charges Figure is based on the expenses incurred by the fund for the period ended 28th February 2025 as per the UCITS rules.

- Includes Investment Management Fee, Operational costs and look-through costs.

The figures may vary year to year.

Fund Commentary - November 2025

Investors’ nervousness about lofty valuations persisted last month and it became increasingly palpable. As in October, volatility reached its highest level since the April “Liberation Day” when President Trump announced sweeping tariffs measures. But, as in October, financial markets regained ground, highlighting that despite being wary and wounded, investors are not yet as a whole prepared to capitulate.

The major UK event was the Budget. In the run-up to the Budget, internal party battles within the Labour party and shifting options at the Treasury underscored uncertainty. After preparing the ground for breaking the Labour manifesto’s pledge not to raise income tax, it quickly became apparent that doing so would be political suicide for Chancellor Reeves and PM Starmer who looked for alternative options to meet their fiscal rules. In the end, the Budget managed to keep their political party happy (by increasing spending, particularly on welfare) as well as bond investors by giving sufficient fiscal wiggle-room over the foreseeable future. It is undeniably yet another Budget increasing spending and taxes while offering little in terms of growth-boosting measures, but it at least managed to beat the worst-case scenario many had priced in going into the event. With the chaotic process leading up to the event, full of leaks and speculation, it should come as a relief to investors that the Chancellor maintained some fiscal credibility and to the public that the bulk of the tax increases won’t hit until the next General Election. The net result was some volatility in both UK government bonds and the British pound, but both recovered earlier losses by the end of the month. Consumer confidence surveys were weak going into the event, but inflation came out lower than the previous month, opening the door for more rates cut from the Bank of England after leaving its benchmark interest rate unchanged mid-November.

In the US, markets experienced turbulence too. Politically, the longest government shutdown in history ended after 43 days, allowing public-sector workers to return to work and economic data to be published again. Subsequent payroll numbers pointed to a stronger employment outlook than previously thought in the summer. Paradoxically, this disappointed investors betting on a rate cut by the US central bank (the Federal Reserve or the “Fed”). Sentiment in bond markets recovered later in the month on the back of speeches from Fed governors reiterating that a rate cut in December might still be on the cards. Meanwhile, after a string of defeats by the Republicans in federal and mayoral elections, including in New York City, it became apparent that Donald Trump is increasingly worried that tariffs raising prices on everyday goods are eroding his political support. As a result, he announced the relaxation of some of the tariffs on agricultural products from Central and South America, including Brazil where tariffs of 40% previously stood. Although he claimed a deal with China, the real outcome was only a modest pause in the trade conflict. Still, given prior tensions between the two countries, it represented an improvement and sent a signal that the President may be open to more flexible policies going forward.

While the above created some gyrations in the bond and currency markets, the bulk of the volatility was concentrated in “hot” assets like cryptocurrencies and technology companies. From their early-October peak, cryptocurrencies slumped around 30% at one point, erasing all their gains for the year. Because these assets trade on sentiment rather than on fundamentals, and because many of those trades are leveraged, the losses tend to be amplified on the way down. This fallout spilled over into other assets, such as technology companies where valuations are high and a shift in sentiment can quickly lead to prices unravelling. A telling example was Nvidia which, despite posting record breaking results that beat expectations lost about 15% from its late-October $5 trillion market capitalization high. Other firms related to the artificial intelligence (AI) boom suffered similarly.

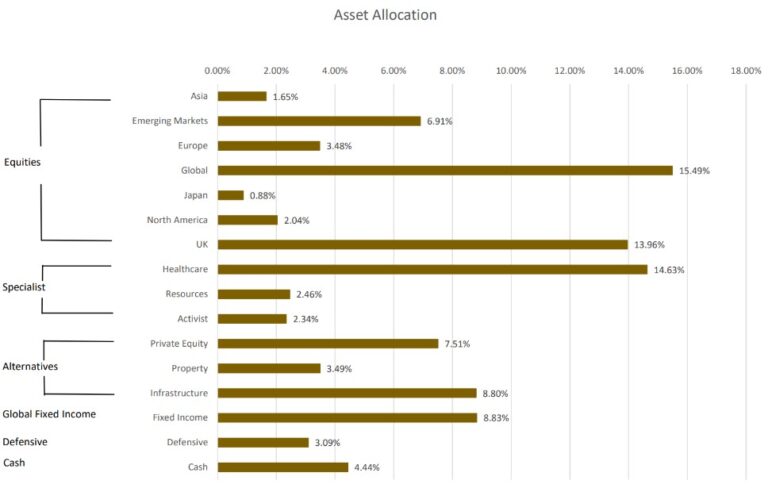

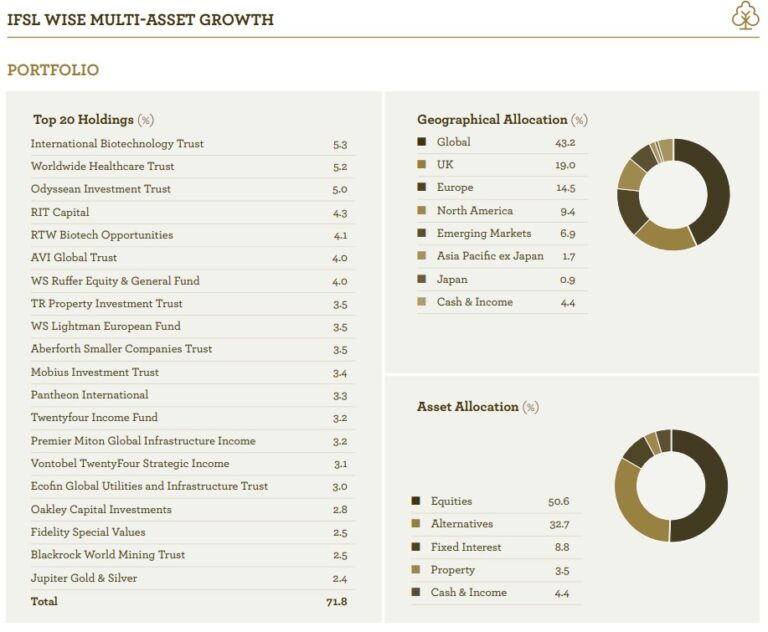

In November, the IFSL Wise Multi-Asset Growth Fund was up 1.6%, ahead of both the CBOE UK All Companies (+0.7%) and its peer group, the IA Flexible Investment sector (-0.6%). Like last month, our top contributors were in the healthcare sector, with all three of our holdings (International Biotechnology, Worldwide Healthcare and RTW Biotech Opportunities) benefitting from strong net asset values (NAVs) growth and discount tightening as the sector gained traction from a broader range of investors. At a time when much attention is focused on AI, it is pleasing to see the exciting biotechnology sector recovering some of the ground it lost compared to technology companies. Since the start of the year, the smaller company biotechnology index delivered more than twice the returns of the Nasdaq index (the main index of technology companies in the US) at 44% vs 22%. And yet, since its previous peak in early 2021, the same biotechnology index is still down 31% vs the Nasdaq up 72%. This gives us reasons to think that we are in the early stages of the recovery in the sector and we continue to be encouraged by the attractive valuations, the increasing pace of innovation, and the accelerating level of acquisitions from larger pharmaceutical companies. Our position in precious metals via the Jupiter Gold & Silver Fund and BlackRock World Mining also contributed positively, benefitting from the increased volatility described above.

On the downside, our basket of renewables and infrastructure names weighed on returns, as did our emerging markets holdings. The former suffered from uncertainty over future government policies on subsidy pricing. Our emerging markets names were hurt by a combination of weakness in Asia related to global concerns about the valuations of AI names and, in the case of Mobius, a large uptake in their redemption facility which led to many investors deciding to exit their position.

In terms of portfolio activity, we took some profit across our healthcare names despite confidence in their medium-term outlook, as well as in private equity (Pantheon International, Oakley Capital), Ecofin Global Utilities and Infrastructure, and Templeton Emerging Markets. We redeployed part of the proceeds into Mobius Investment where we believe the redemption event provides an attractive entry point. We also increased TR Property after the Budget. The remainder of the profits was kept in cash, ready for deployment when further opportunities arise.