For Professional Clients Only

Macro & Market Update

2022 had a rather tumultuous start. In January, the S&P500 (the main index representing US stocks) fell by more than 5% in Dollar terms, its worst monthly performance since the start of the Covid crisis in March 2020. Even more telling, the Nasdaq index of US technology stocks fell by 9% in Dollar terms, the worst since the Great Financial Crisis of 2008. While investors looked through the rise in Covid cases at the end of last year, they shifted their focus in January, once again, on inflation and the speed at which central banks will raise rates. There was very little ambiguity at the meeting of the US Fed about their resolve to combat inflation with a first hike hinted for March. With US inflation coming out at 7% year-on-year and taking hold in an increasing number of goods and services, interest rates at 0.25% cannot be sustainable, particularly when growth is robust and the job market tight. At the start of 2022, the bond market was pricing a less than 5% probability of 4 rate hikes in the US in 2022. By the end of January, there was almost a 50% chance of at least 5 rate hikes priced in. Reflecting a similar view, US 10-year bond yields moved from ~1.5% to close to 2%.

As highlighted with the performance of the Nasdaq earlier, this reassessment of the speed of future monetary policy tightening hit technology stocks and growth names the most. Higher interest rates directly force analysts to increase the discount rate they use to assess the present value of future earnings. A higher discount rate mechanically reduces the value of those future earnings, which makes the high valuations on display in the technology sector much harder to justify. Moreover, after the tremendous growth that the sector has had for more than a decade and which accelerated since the Covid crisis (the Nasdaq more than doubled between the trough in March 2020 and the end of 2021), many investors have been prompt to pull the trigger and lock in some of those gains.

Conversely, value sectors such as Financials or Energy, performed better. This was also reflected at the country level with UK Equities, one of the strongest on the month, helped by the composition of its stock market (low weighting in technology and high weighting in financials and energy). While it is too early to say whether we are witnessing the great rotation from growth into value, it is somewhat ironic that this move is happening at a time when inflation expectations could be peaking. It is indeed going to be increasingly hard for year-on-year inflation numbers to keep surprising on the upside, simply because of a high base effect. That is not to say we don’t think a rotation is warranted: we certainly think it is, but this is because of the contrasts we observe between the excesses in growth assets and the indifference towards value ones. That discrepancy alone should have been a catalyst for a rotation a long time ago but, as is often the case, the drivers of rational market moves are not always the most obvious ones.

Fund Performance

Wise Multi-Asset Growth

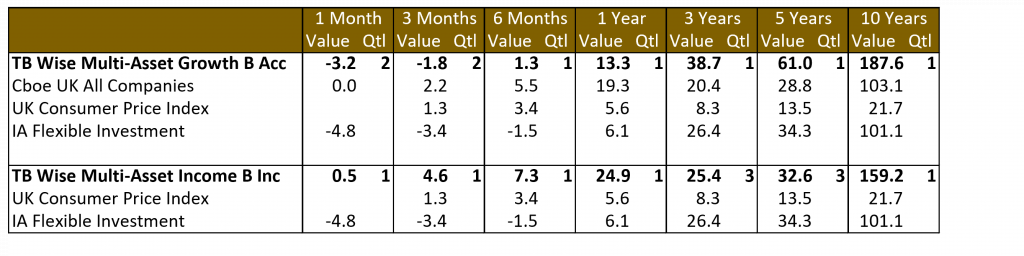

In January, the TB Wise Multi-Asset Growth fund was down 3.2%, behind the CBOE UK All Companies index (flat) but ahead of the IA Flexible Investment sector (-4.8%). As mentioned, the UK index was one of the most resilient equity index last month and, although we have a number of UK value equity managers in our portfolio (~12% exposure), it wasn’t enough to keep up in line with the benchmark. Our strongest contributors were mining (Blackrock World Mining Trust), financials (Polar Global Financials Trust) and more defensive strategies (Ecofin Global Utilities and Infrastructure Trust, TwentyFour Income Trust). On the negative side, without surprise, the few technology-exposed names we hold detracted from our performance (Herald Investment Trust, International Biotechnology Trust). While Herald is a technology trust we halved in size in 2020 after strong performance and only represents 1.1% of the fund, International Biotechnology Trust is a holding we have been adding to over the past 6 months. Despite its name, the biotechnology sector underperformed not only the technology sector but also the broader market since last summer, and we think it presents an attractive value opportunity. Unfortunately for now, it is painted with the same broad brush as the pure technology sector and is sold in sympathy. Other detractors were found in the winners we discussed in recent commentaries, as investors rushed to take profits where they could, leading to investment trusts discounts to widen. This was the case for Caledonia Investments and Pantheon International in the Private Equity space.

Staying with the Private Equity sector, it would be remiss not to mention the strong annual results from Oakley Capital Investments, our largest Private Equity holding. After updating their valuations to the end of December, they disclosed a 6-month return of 21%, taking the growth for the year up to 35%. Most pleasingly, the vast majority of this return came from underlying growth and not from improvement in valuations, which support our conviction in the team’s ability to source, manage and exit deals successfully. The trust continues to trade at a wide discount of 23% and we believe there is much more value in the name.

Wise Multi-Asset Income

In January, the TB Wise Multi-Asset Income fund rose 0.5% compared to a fall for the IA Flexible Investment sector of 4.8%. The biggest contributor to performance came from Blackrock World Mining, which performed strongly on the back of strong iron ore prices and a narrowing of its discount to net asset value. Strong performance in Temple Bar reflected its value style and the strong performance over the month from holdings, such as BT, Vodafone, BP, Shell, Barclays and Standard Chartered. Other value managers investing in companies listed outside the UK, such as Schroder Global Equity Income and Murray International also performed well. Certain direct financial holdings performed strongly, such as Standard Chartered, Paragon and Aviva, however, the performance was not uniform. Unsecured lenders, Provident Financial and Morse’s Club were weak on concerns over the negative squeeze on consumer finances from higher energy bills and mortgage rates. We believe these concerns are manageable and more than discounted in current valuations. It was encouraging that our fixed income allocation in the fund made positive returns over the month. Our holdings in Starwood European Real Estate Finance and GCP Infrastructure are both exposed to loans where the coupons have inflation protection built in and both provided encouraging updates during the month. On the negative side, Princess Private Equity and International Biotechnology Trust performed poorly falling more than 10% in the month. Whereas we have been reducing our exposure to the former given its recent strong performance and narrow discount, we have added to International Biotechnology Trust whose valuation is now back to levels last seen in 2017.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

We took advantage of volatility to add to some of our names looking attractively valued, namely International Biotechnology Trust and Fidelity Asian Values. Early in the month, we increased our allocation to Blackrock World Mining Trust which was then trading at a wide discount. We also added to our position in the AVI Japan Opportunity Trust following a meeting with the manager who highlighted a number of exciting value opportunities they are currently exploring. Finally, we added a new position in the Blackrock Frontiers Investment Trust which we believe will add attractive diversified growth to our portfolio. We financed those purchases by taking small profits in AVI Global Trust and Oakley Capital Investments, as well as by reducing the fund’s cash position.

Wise Multi-Asset Income

Over the month, we have further diversified the sources of income in the portfolio. We sold out of our holding in Aviva and trimmed Paragon, Schroder UK Mid Cap and Temple Bar. This follows strong performance and reduces our UK Equity allocation. We have increased our equity allocation internationally, adding to our holding in the Schroder Global Equity Income value fund and initiated a holding in Blackrock Frontiers at an attractive discount. Both managers see good absolute value opportunities in their markets and are delivering natural income yields over 4%. Finally, we initiated a holding in John Laing Environmental Assets, a fund invested in environmental infrastructure investments, such as wind and solar farms and aerobic digestors. The fund yields 6.6% with much of the income supported by subsidies and inflation protected. Having traded at a premium to net asset value above 15% for a long time, we were able to invest at a more modest premium of 3% at a point in time where rising power prices look set to drive asset values higher.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Disclaimer

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.