For Professional Clients Only

Macro & Market Update

The desire of the world’s central bankers to curb inflation has not moderated, but it is now accompanied by clear evidence of a slowdown in global economic activity. Whilst the path for global interest rates continues to rise, investors are focused on the potential for a reduced pace of rate hikes, with the eventual peak closer at hand. Inflation remains elevated, with the higher than expected US inflation data early in the month quashing hopes of a more immediate pivot in monetary policy from the Federal Reserve, however, there are encouraging signs that the pressure from some of the key upward drivers, notably gas prices across Europe, has moderated significantly. In the US, the impact of higher interest rates is most obviously being felt in the mortgage market with 30-year rates reaching 7.2% in the month, their highest level in two decades. This is feeding through into weaker housing sales, new housing starts and weaker than expected consumer confidence. Manufacturing data also showed that this part of the US economy was contracting whilst business optimism fell for the 4th straight quarter and at a sharper pace. Investment markets will study upcoming data carefully for any signs the continued strength in employment and average hourly earnings is showing signs of weakness. UK investors looking back at the month on Halloween will be forgiven for feeling the last 6 weeks of politics has been something of a nightmare from which they have woken up. Both the Chancellor and the Prime Minister were ejected from power following the bond market panic that accompanied September’s mini-budget, its unfunded fiscal spending and the hopeful aspiration of achieving 2.5% GDP growth. The new Chancellor has almost entirely unwound the policies it contained. In addition to scrapping most of the newly proposed tax cuts, the prior commitment to reduce the basic rate of income tax to 19p was also abandoned. In total, these measures should raise an additional £32bn of revenues annually, closing around half of the Institute of Fiscal Studies’ estimated ‘black hole’ in the public finances. Additionally, the household energy support package will only run until April; the fiscal impact of that change depends on the highly unpredictable performance of wholesale gas prices over the next few months. By the end of this Parliament, tax as a share of total UK GDP is set to rise to 36%, its highest in more than 70 years, which highlights the constraints facing the Chancellor in his upcoming Autumn statement to further balance government spending. Increasing taxes further looks unpalatable as does reducing government spending at a time when public sector pay increases are running at 2.2% compared to 6.2% for the private sector and inflation is extremely high. Against this challenging backdrop, investors got broadly what they wanted from the latest Conservative leadership team, with sterling returning to pre-mini budget levels and UK government bond yields fell sharply. 10-year government bond yields have fallen over 1% from their peak and 30-year government bond yields that were affected by forced selling from pension funds have fallen nearly 1.5% in three weeks. These are extraordinary moves in such a short time period.

Finally, Chinese economic data which was delayed till after the National Party Congress showed headline GDP ahead of expectations at +3.9% but well below the governmental guidance of 5.5%. However, trade growth disappointed and the extension of the zero Covid approach continues to weigh on the outlook. Markets reacted poorly to the data as well to the authoritarian manner in which Xi Jinping secured a third term as the Chinese Communist party’s head.

Fund Performance

Wise Multi-Asset Growth

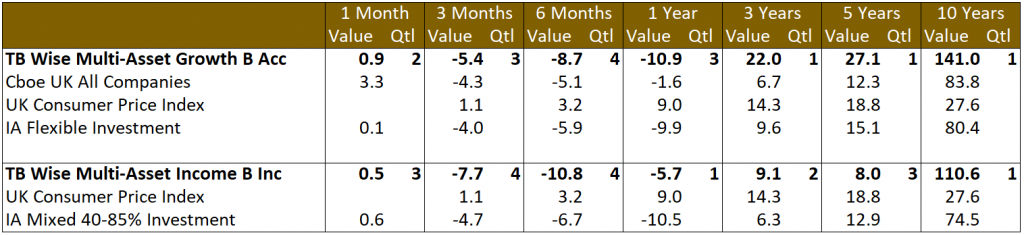

In October, the TB Wise Multi-Asset Growth fund was up 0.8%, behind the CBOE UK All Companies Index (3.3%) but ahead of the IA Flexible Investment sector (+0.1%). The change of political leadership in the UK, the U-turn on almost all the unfunded fiscal measures announced last month, and the commitment of the new government to fiscal responsibility helped bring stability to UK assets, propelling our UK equity funds to the top of our contributors list. In particular, Fidelity Special Values performed strongly helped by the powerful combination of improving Net Asset Value (NAV) and a tightening of its discount. This compounded rebound is the typical scenario we would expect to unfold once risk assets reach their bottom and the reason why we are confident holding on to some of investment trusts that have been harshly penalised so far this year.

The tightening of discounts was also palpable across our other holdings with the portfolio weighted average discount improving by close to 1% since the end of September. It is too early to call the low, but it is encouraging to see that the mechanics of investment trusts prices we have relied on since inception in our fund remain intact.

Unsurprisingly given the negative political and economic data in China, our largest detractors were found in emerging markets with Fidelity China Special Situations the worst affected. Sentiment and flows have reached intense negativity in the region for months, so a lot of bad news is already priced in and is reflected in attractive valuations. Caution remains warranted but given the extreme levels now on display in some of those emerging markets, a small improvement in sentiment could have a powerful effect, hence why we remain exposed to the area.

Wise Multi-Asset Income

In October, the TB Wise Multi-Asset Income fund rose 0.5% marginally behind the IA Mixed 40-85% Investment sector which rose 0.6%. Given the improved sentiment towards the UK described above our strongest performers during the month came from our UK focussed investment trusts, such as Aberforth Smaller Companies and Fidelity Special Values, as well as our direct equity holdings, such as Paragon and Legal & General, which had previously been weak on the back of higher bond yields and concerns over the outlook for the UK economy. Overall market sentiment also improved as hopes that an end to the monetary tightening cycle was in sight. Global Equity funds, such as Schroder Global Income and Murray International, performed well as did our commodity related funds, which further benefitted from discount narrowing. On the negative side, Abrdn Asian Income performed poorly as sentiment towards China and the wider region soured. Our property holdings suffered another weak month of performance as the market has aggressively discounted the prospect of future falls in net asset values to reflect the rise in bond yields. Whilst it is correct to expect values to fall in sympathy and company statements have already shown valuers have started to reflect this in the latest September valuations, we believe the extent of the falls is overly aggressive. In certain cases, the shares now trade at a near 50% discount to net asset values posted in March of this year whilst the commentary from the companies around tenant demand and rental growth remains encouraging. Yields that have scope to grow as a result look highly attractive whilst balance-sheets look increasingly robust as our holdings have reduced debt over the last two years.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Income

Over the month we increased our fixed income exposure via the TwentyFour Income and Strategic Income funds given the attractive yields on offer from both funds. We reduced certain funds which have performed relatively well and where discounts were tight, such as Ecofin Global Utilities and Infrastructure, Middlefield Canadian Income and International Biotech and topped up UK equity and property holdings where the reverse has been the case (Abrdn Property Income, Fidelity Special Values and Temple Bar).

Wise Multi-Asset Growth

Like in September, we continued to cautiously allocate our cash reserves to fixed income strategies via the TwentyFour Strategic Income Fund. We also switched our exposure from the TwentyFour Absolute Return Credit Fund into the broader Strategic Income Fund as we are keen to take advantage of the attractive yields on display across the wider bond market. Our total Fixed Income exposure now stands at 10%.

Given their relative performances, we switched some of our exposure from the Fidelity Asian Values Trust into the Fidelity China Special Situations Trust. More broadly in emerging markets, we were also keen to benefit from the attractive discounts on display and thus exited our position in the Somerset EM Discovery Fund (an open-ended fund) to switch into our existing EM investment trusts. We also added to the KLS Corinium EM Fund, a relatively new position for the fund, where we think the manager’s strong macro-economic focus will prove particularly useful in today’s environment and will complement our more EM stock specific managers nicely.

Finally, we took some more profit out of Ecofin Global Utilities and Infrastructure Trust and topped up our position in the Fidelity Special Values Trust.

At the end of the month, our cash stood just below 3%.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.