For Professional Clients Only

Macro & Market Update

Data released in June continued to paint the same mixed, albeit resilient, picture observed for the past few months. Manufacturing and services indices showed some contraction in levels of activity, while anecdotal evidence from companies, such as rising numbers of bankruptcies, reinforced the message that conditions are getting difficult. On the other hand, job markets in developed countries remain tight with low unemployment, which helps support wage inflation and consumption, itself fuelling inflation even more.

While those issues are the same on both sides of the Atlantic, the UK is, once again, the country where the problems appear the most acute. Wage inflation was strong last month, particularly in the private sector, recording a year-on-year increase of 7.6%. The headline inflation figure of 8.7% surprised on the upside for the fourth month in a row, but it is the core inflation figure (headline inflation stripped out of the more volatile items such as energy and food costs) which caused some panic by increasing to 7.1% versus 6.8% and 6.2% in April and March respectively. This is the number that preoccupies central bankers at the Bank of England (BoE) as it is the one they are, theoretically, the most able to control by increasing interest rates. After 12 consecutive interest rates hikes, the fact that core inflation keeps rising put pressure on the BoE and forced it to increase rates a 13th time by 0.50% instead of its usual 0.25%. This negative surprise sent UK bond yields (which move inversely to prices) to levels not seen since last autumn’s chaotic “mini-budget”, creating another episode of panic. Following the poor inflation numbers and subsequent BoE decision, investors revised their future interest rates expectations further to more than 6% by the end of 2023. Those stood at around 4.5% less than two months ago, highlighting how unsettled markets are.

Although inflation pressures are not as exacerbated in the US and Eurozone as in the UK, similar dynamics are at play and the UK example is likely to serve as a warning to other central bankers that it is safer to err on the side of more tightening than too little. This was the clear message from both the US Federal Reserve (Fed) and the European Central Bank (ECB) at the end of the month after the former paused its hiking process and the latter stayed on track with a 0.25% hike. Both indicated clearly that interest rates had further to rise and that they were likely to stay elevated for longer. No central banker will admit to this openly but, given how sticky inflation is proving to be, a recession engineered by higher interest rates is probably the only solution at this stage, so investors should brace themselves for that scenario. Finally, we should note that China is increasingly going against the trends highlighted above with close to 0% inflation and a subdued economic recovery, which pushed its central bank to ease lending rates in June.

In that economic context, bonds were, understandably weak, as were UK equities, particularly smaller and medium-sized companies which are more domestically focused and tend to be more easily penalised in a panic due to a lack of liquidity. In contrast, other equity markets (US, Japan, Europe, Emerging Markets) were broadly oblivious to concerns about future interest rates and recession risks and continued their march higher to end the first half of 2023 strongly.

Fund Performance

Wise Multi-Asset Growth

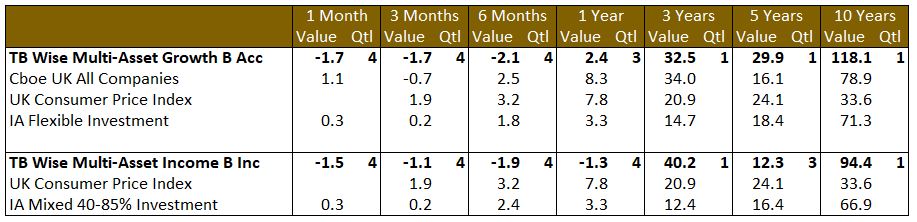

In June, the TB Wise Multi-Asset Growth Fund was down 1.7%, behind both the CBOE UK All Companies Index (+1.1%) and its peer group, the IA Flexible Investment Index (+0.3%).

Despite having correctly erred on the side of caution in anticipation of rising volatility in recent weeks, investment trust discounts widening have hurt our performance. We talked in detail in past commentaries (most recently in September 2022) about how performance in investment trusts tends to be amplified because excitement/fear about the underlying assets they invest in translates into tighter/wider discounts, thus compounding the rise/fall of those assets. Last month was such an instance when fears of higher interest rates for longer in the UK led to increased recessionary concerns which hurt domestically oriented UK equities. While our Fund’s direct UK exposure is only ~16%, all of our investment trusts (66% of the portfolio) are listed there. Moreover, the trusts and assets we tend to favour are not in the largest companies, because we find many more pricing opportunities away from mainstream names. In June, the UK medium-sized companies index underperformed its large companies counterpart by 2.7%, due of its greater exposure to domestic companies. Many of our investment trusts form part of that index and, as is often the case in panic-driven weaknesses, were sold indiscriminately as part of that basket of names, thus driving discounts wider. Our focus on investment trusts and small/medium sized companies has historically been a strong contributor to our good long-term performance but there are periods of time (usually short) when it proves detrimental. The long-term benefits of our approach traditionally outweigh the short-term volatility though, so we continue to believe our strategy will deliver on its objectives.

To quantify the impact of this phenomenon on our portfolio, we estimate that the widening of discounts on the investment trusts we hold cost our Fund around 1.4% in June.

Wise Multi-Asset Income

In June, the TB Wise Multi-Asset Income Fund fell 1.5%, behind the IA Mixed Investment 40-85% Sector, which rose 0.3%. Almost all of this underperformance can be attributed to the widening of discounts to net asset values (NAV) of our investment trust and property REIT holdings. Historically, the ability to exploit wider than average discounts to NAV has provided an extra source of investment return over the medium to long term, however, in the short-term movements in discounts can create greater levels of volatility. June was one such period, with our property and infrastructure holdings being particularly impacted. Whilst higher interest rates are likely to put pressure on asset valuations as alternative ‘risk-free’ sources of income in the form of government debt look relatively more attractive, the yields available from both asset classes look highly attractive when the discount the shares trade at are factored in and, unlike fixed income, the income paid out to investors over time should be able to grow. In the case of our property holdings, tight supply-demand dynamics provide a favourable backdrop for rental growth whilst our infrastructure holdings have inflation-linked, often regulated revenue streams that will feed through over the next year. Furthermore, should central bankers prove successful in engineering an economic slowdown to tame inflation, the defensiveness of the underlying holdings are likely to become increasingly attractive. As an example, HICL Infrastructure, which invests in essential infrastructure assets, such as utilities, hospitals and toll roads saw its discount widen from 12% at the start of the month to 26% at its low point and ended the month at 18%. Ecofin Global Utilities and Infrastructure, Pantheon Infrastructure and GCP Infrastructure were all similarly impacted. There was greater divergence of performance within our property holdings with Ediston Property, Urban Logistics, Impact Healthcare Reit and Empiric Student Property all notably weak whilst Palace Capital held up well, helped by its commitment to realise the discount to its NAV by disposing of its portfolio. Elsewhere, our equity holdings were caught between strong to resilient NAV performance facing a headwind of discount widening. CC Japan Income & Growth continued its strong year to date performance whilst both our commodity related funds enjoyed a rebound in performance from recent weakness.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, we added a new position in the RTW Biotech Opportunities Trust. It is unique in that space by bridging the gap between private and public markets, investing in companies from their earliest private stages (even founding some of them) and nurturing them all the way to fully fledged listed companies. This full lifecycle approach is extremely compelling and brings a complementary angle to our other biotechnology holdings. The sector and this particular approach can be volatile but, with the sector historically cheap and the trust itself trading at 30% discount to Net Asset Value, the margin of safety is attractive.

As always, we also rotated the portfolio out of stronger performers (mainly equity holdings) into relative laggards (private equity and infrastructure).

Finally, as a silver lining in what was, otherwise, a challenging month, we are pleased to announce that the TB Wise Multi-Asset Growth Fund was named Fund Manager of the Year 2023 by Investment Week in the Flexible Investment category. Details on the methodology can be found here.

We would like to thank you for your support over the past few years, particularly the last 3 which have been particularly turbulent since Covid!

Wise Multi-Asset Income

In June, we were active in taking advantage of relative value opportunities that emerged over the month. In particular, we reduced our holding in Palace Capital and added to both Urban Logistics and TR Property. Whilst we support the disposal strategy at the former, we prefer exposure to the industrial subsector rather than regional offices and leisure assets given current valuations and the prospects for future rental growth. Our direct Vanquis bond holding was redeemed at par (the price at which the bond was originally issued), an investment made in the depth of the Covid crisis which has delivered both capital growth and high income returns. We used the proceeds to increase our holding in the TwentyFour Strategic Income fund as well as HICL Infrastructure, maintaining the defensive allocation within the portfolio. We switched part of our holding in CT Private Equity into ICG Enterprise Trust, broadening our exposure to the Private Equity sector whilst also benefiting from a significantly wider discount. Finally, we took some profits in both Paragon and CC Japan Income & Growth, both of which have delivered strong performance in recent weeks.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.