For Professional Clients Only

Macro & Market Update

Despite a backdrop of more resilient economic growth than previously expected, the message from central bankers shifted somewhat during the month away from the need to raise rates further, with the emphasis now focussed on the need to maintain rates at these high levels until the battle against inflation has been clearly won. In the US, economic growth in the second quarter came in stronger than forecast, however, there are some signs that tighter monetary policy is having an impact in cooling the economy. Manufacturing data, in particular, has been weak and for the first time there were signs that tightness in the labour market was easing. Despite stronger than forecast wage growth, jobs growth slowed more than expected in June and the previous two months’ data were revised lower. Whilst the unemployment rate remains at a multi-decade low, markets took this news positively as it marks a turning point that could herald the peak of the interest rate cycle in the world’s leading economy. This optimism was fuelled further by a better-than-expected inflation number. Core inflation, which strips out volatile food and energy prices, registered a monthly gain of only 0.2% in June, the smallest increase in nearly two years whilst headline inflation is now running at 3%, its slowest pace since March 2021. Against this backdrop of softening but more resilient growth than previously feared, central banks in the US and Eurozone increased interest rates by 0.25% and the better news around inflation buoyed equity markets, hopeful that interest rates might be peaking at the same time as the economy avoids the more severe economic slowdown initially anticipated.

In the UK, at the time of writing, the Bank of England is yet to meet but markets expect another 0.25% interest rate rise to 5.25% and similar language around the need to keep interest rates high until inflation has been tamed. There was encouraging news in this regard during the month, with the UK seeing inflation fall to a 15-month low of 7.9% in June. The UK has been a notable laggard when it comes to inflation easing so the fall from 8.7% the previous month was welcome and much better than the 8.2% expected. The positive news extended beyond consumer prices as producer input prices fell 2.7% year-on-year, mainly driven by lower oil prices, signalling the pressures on future consumer inflation are easing. The positive news around inflation led to markets lowering their expectations of the level of future interest rates this time next year by nearly 0.5%. More interest rate sensitive investments, such as property, infrastructure and cyclical equities performed strongly as a result.

Elsewhere, China released economic data that showed the economy losing momentum in the second quarter. Chinese exports suffered their biggest year-on- year decline since the start of the Covid pandemic, hit by weaker international demand at a time when the domestic economy is strained by a weak property market and a disappointing rebound in activity since Covid restrictions were lifted last year. Investor optimism, however, that the authorities would have to provide further stimulus to the economy buoyed equity markets.

Fund Performance

Wise Multi-Asset Growth

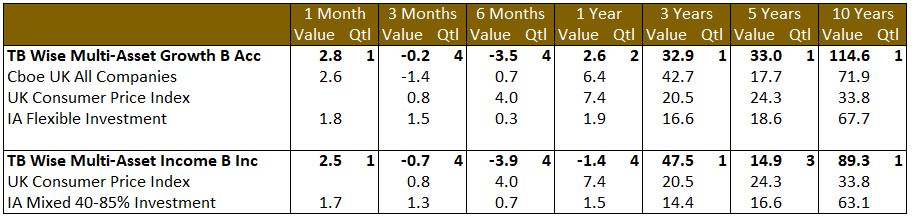

In July, the TB Wise Multi-Asset Growth Fund was up 2.8%, ahead of both the CBOE UK All Companies Index (+2.6%) and its peer group, the IA Flexible Investment Sector (+1.8%). Performance was driven by a recovery in some of the weak performers of late, mainly visible through a tightening of our investment trusts discounts, a correction from the sharp moves wider which hurt us in June. More specifically, our top contributors were found in UK equities, as our value and smaller companies biases clawed some of their recent underperformance back. The Fund also benefitted from the rebound in China, mainly through Fidelity China Special Situations, but also via our broader emerging markets exposure. Finally, our listed private equity trusts also helped performance, particularly ICG Enterprise Trust which saw its discount tightening back below 40%.

There were few detractors during the month. Worldwide Healthcare Trust remained weak, as was the rest of the biotechnology sector, now presenting very attractive absolute and relative valuations, combined with strong growth prospects. The theme of mergers and acquisitions should also continue to support the sector as large pharmaceutical companies critically need to replace their drugs pipeline to avoid a patents cliff. Baker Steel Resources Trust also fell after announcing a reduction in valuations in some of its largest positions following its half-yearly review. Those reductions were mainly caused by the manager’s cautious valuation approach as opposed to tangible events, but highlighted nonetheless how difficult the environment is for early-stage mining companies relying on financing to complete new projects.

Wise Multi-Asset Income

In July, the TB Wise Multi-Asset Income Fund rose 2.5%, ahead of its peer group, the IA Mixed Investment 40-85% Sector, which rose 1.7%. Our property holdings were the strongest contributors to performance as investors welcomed a reprieve from the persistent disappointing news around inflation and the prospect of ever higher interest rates. Despite net asset values that have been rapidly marked down by valuers, shares in the property sector have continued to sit at historically high discounts and offer investors high implied yields on the underlying assets. At the operational level, news around tenant demand continues to be positive, particularly in those subsectors of property, such as industrial, student and retail warehouses, where supply-demand dynamics remain favourable. Our largest holding in the sector, Ediston Property, a specialist focussed on retail warehouses, rose strongly over the month, boosted by the broad rebound in the sector but further helped by a positive trading update showing its asset value had grown in the quarter, vacancies continued to fall and new rental agreements had been signed at rental levels ahead of their independent valuer’s estimated levels. In addition, the board announced that the strategic review they are currently undertaking to realise that value inherent in the discount to net assets is nearing completion and encouraging progress has been made. Similarly, Urban Logistics provided a positive update around lettings and announced that they have quickly been able to reassign nine leases following the administration of one of their tenants, highlighting the strong demand for the underlying warehouse assets.

Our equity fund positions performed strongly during the month, particularly our UK-exposed managers. Fidelity Special Values and Temple Bar performed particularly strongly during the month, helped by the change in views around the direction in monetary policy, by positive news relating to the Bank of England stress tests for the UK banks and by strong performance from commodity names on the back of expected fiscal stimulus in China. This also helped our two commodity related funds, Blackrock World Mining and Blackrock Energy and Resources, as well as Aberdeen Asian Income. The broader positive sentiment also helped our direct financials holdings with the exception of Vanquis Banking Group, which provided a disappointing update to the market around higher-than-expected cost inflation.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, despite the improving general sentiment in financial markets, we maintained our value discipline. Risks to the global economy remain and could easily derail the current mood. Amongst the investors who have waited on the sidelines for months, we note increasing signs of capitulation, with money chasing performance and caution being thrown to the wind. Discipline is critical in this environment because the risk of getting burnt is high. As such, we took some profits in good performers Schroder Global Recovery Fund and European Smaller Companies Trust. In turn, we added to some relative underperformers which present more defensive characteristics but also attractive upside, namely Ecofin Global Utilities and Infrastructure Trust, TwentyFour Income Fund and Worldwide Healthcare Trust.

Wise Multi-Asset Income

Over the month we sold our holding in Palace Capital, taking advantage of a company share buyback, as we were disappointed by the management remuneration scheme accompanying the proposal to realise the asset value of the company. Given attractive discounts to asset value elsewhere, better liquidity and more favourable subsector exposure, we switched our holding into TR Property and Urban Logistics. We topped up our holding in Ecofin Global Utilities and Infrastructure and TwentyFour Income at attractive discounts. On the back of the disappointing Vanquis trading update, we exited our remaining holding, ending the month with cash of 2.6%.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.