For Professional Clients Only

Macro & Market Update

Investment sentiment soured throughout the month as concerns grew over central bank tightening of monetary policy in the face of headwinds that already look set to slow economic growth. Hopes that the Ukraine invasion might reach a negotiated settlement have receded and markets increasingly accept that the supply shock to energy and food production will exacerbate underlying inflationary conditions for a protracted length of time. Softer monthly activity readings in China reflected a weaker property market as well as a broader loss of economic momentum. In recent weeks this has been compounded by a spate of lockdowns that aim to curb the country’s worst Covid-19 outbreak in two years. The resulting disruption to global supply chains has led to a number of multi-national firms (such as Apple, General Electric and Pernod Ricard) warning that this will lead to higher input costs, production delays and reduced earnings forecasts. Reflecting this backdrop, the International Monetary Fund updated its economic growth forecasts in the month and cut its forecast for global economic growth for 2022 by 0.8% to 3.6% and increased its forecast for developed world inflation by 1.8% to 5.7%.

Inflation remains a central concern for investors and central bankers. UK inflation hit a 30-year high of 7.0% in March whilst core inflation, which strips out the more volatile energy and food components rose 5.7%, up from 5.2% in February. The increase in prices is also broadening out with 75% of the CPI basket (Consumer Price Index) seeing price increases greater than 3% compared to 25% a year ago. These increases are ahead of the Bank of England forecast and increase the likelihood the Bank of England raise interest rates by a further 0.25% to 1% at the start of May. Following similarly strong inflation and employment numbers, the market is pricing in an increasingly aggressive path for interest rate hikes in the US. Those increased interest rate expectations have seen 10-year US bond yields hit 3% for the first time in more than 3 years, increasing the cost of mortgages and corporate borrowing costs, and leading investors to predict that economic growth in outer years will slow as a result. Yield curves have flattened and in some instances inverted (yields on longer dated bonds have fallen below shorter dated ones) suggesting investors now believe that the predicted path for interest rates to tame inflation can not increase further without risking tipping the US economy into recession. There was a wide divergence in performance in equity markets in April with UK equity indices holding up well given their high commodity exposure whilst elsewhere performance reflected greater risk aversion. US markets were notably weak in dollar terms with the Nasdaq Index of leading technology companies witnessing its biggest one-month sell-off since the Global Financial Crisis in 2008. Highly valued growth stocks have performed strongly in the subsequent years on the back of strong relative growth and exceptionally low discount rates which have pushed up valuations to extremely elevated levels. Over the course of the month the Nasdaq fell 13% as inflation fears pushed up longer dated bond yields which put pressure on valuations whilst earnings disappointed at technology names Netflix, Amazon and Alphabet. This stood in stark contrast to the positive earnings momentum in historically cheap sectors, such as energy, which are delivering earnings above expectations on the back of strong oil & gas prices. Bond markets continued to fall as interest rate expectations rose. The dollar was notably strong surging to its highest level in two decades as investors believe interest rates will move much higher in the US than in other countries. This has the effect of somewhat reducing the negative returns delivered by US markets for UK investors but also increases domestic inflation as the pound weakens.

nds

Fund Performance

Wise Multi-Asset Income

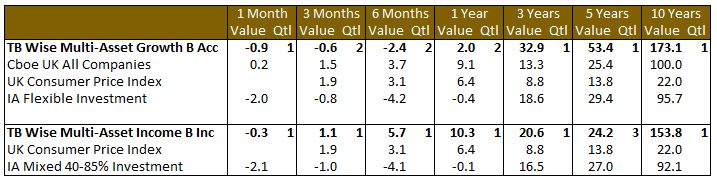

In April, the TB Wise Multi-Asset Income Fund fell 0.3%, ahead of the IA 40-85% Investment Sector which fell 2.1%. The increased outlook for gas prices has seen power price expectations rise over the last few months. As a result, our holdings in the renewables and infrastructure and utilities area, such as John Laing Environmental, GCP Infrastructure and Ecofin Global Utilities and Infrastructure performed strongly as did Blackrock Energy & Resources, which is more directly exposed to energy prices. Our fixed income holdings performed well, demonstrating good defensive characteristics in a risk-off environment and showing the merits of holding floating rate exposure to protect against rising interest rates. Twenty Four Income performed well having been weaker last month. Despite a series of encouraging Q1 net asset value (NAV) updates, the performance of our property holdings was mixed. Standard Life Investment Property Income reported 5.5% growth in its NAV whilst Ediston Property reported 6.5% growth. Both companies trade at discounts to NAV greater than 20% and above their historic average, however, both shares fell over the month which appears to be at odds with the improving outlook both companies face. Palace Capital, Impact Healthcare Reit and New River Reit, however, all rose on positive trading updates. Our financial holdings dragged on performance as the market looked beyond the benefits to the sector from rising interest rates towards the negative implications for credit quality from cost-of-living pressures. Polar Capital Global Financials and Provident Financial both fell as a result, despite the low sector valuation.

Wise Multi-Asset Growth

In April, the TB Wise Multi-Asset Growth fund was down 0.9%, behind the CBOE UK All Companies Index (+0.2%) but ahead of the IA Flexible Investment sector (-2%). Given our long-held wariness about valuations in the technology sector, the sharp moves described above had little impact on our performance. Our only direct exposure to listed technology stocks is through a small exposure to Herald Investment Trust which has a bias to smaller UK technology companies rather than the large US names that are currently in the spotlight. The trust also trades at a historically wide discount. We are, however, exposed to certain technology names through our private equity holdings but we continue to like these since they often trade at an underlying valuation discount to their listed peers and we are able to access these companies via investment trusts which themselves sit at very attractive discounts.

Our main detractor was the AVI Japan Opportunity Trust which suffered from a weak underlying market, weak Japanese Yen and volatility in its discount. Our position in the Polar Capital Global Financials Trust also hurt performance. Although inflation and rising rates should, all else being equal, benefit financial stocks, growth fears created some uncertainty and company results were mixed.

On the positive side, Caledonia Investments and Oakley Capital Investments in private equity both performed well driven by solid underlying investments results and, possibly, appetite from investors looking to acquire growth more attractively than in listed markets. Finally, our two bond positions, GCP Infrastructure and TwentyFour Income Fund had a good month, showing the benefit of holding floating rate strategies in an inflationary environment.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Income

During the month portfolio transactions were limited. We took advantage of a wide discount in International Biotech to top up our holding as the price fell back to the same level it stood at in 2017. Conversely, we trimmed our holding in Middlefield Canadian on the back of exceptionally strong performance year to date. We ended the month with 3.0% in cash.

Wise Multi-Asset Growth

There was little in terms of portfolio activity last month. We had cautiously put some of our cash to work at the beginning of March but had stopped when sentiment recovered and markets rebounded because we feared they might have got ahead of themselves. We kept that holding pattern throughout the month as we observe where the dust will settle. We believe that our diversified and balanced portfolio offers attractive value from here so do not feel the need to sell into weakness but, equally, we want to be careful in what remains a volatile environment. We remain on the look-out for anomalies and oversold opportunities and, as such, added to our position in the International Biotechnology Trust. As mentioned in previous monthlies, we find the biotechnology sector attractive at these levels but acknowledge that it is currently trading in sympathy with the broad technology universe, despite presenting very different drivers and valuations. The International Biotechnology Trust briefly traded at more than 10% discount in April, which is wider than average, so we topped our exposure up. We ended the month with 3.2% in cash.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.