For Professional Clients Only

Macro & Market Update

Despite good headline performance numbers across most equity markets, October saw the most volatility since the announcement of global tariffs by President Trump in April. We have highlighted for some months that high valuations left very little room for error, and last month a number of developments began to dent investors’ seemingly Teflon-like optimism. These were merely dents, however — signalling potential areas of weakness and calling for caution rather than a full scale retreat.

The main source of October’s volatility was, once again, tariff related. The threat of escalation in the trade war between the US and China, triggered by Chinese controls on exports of rare-earth minerals and imports of US chips (retaliation to US tariffs) and counterthreats from President Trump, spooked markets. The fear of an intensifying conflict triggered sharp falls in equities and cryptocurrencies. It then became clear that negotiations remained open, culminating in a meeting between Presidents Trump and Xi in South Korea at the end of the month, where a framework for future deals was announced, thus averting, in the short term, the worst-case scenario. China appears, so far, to be the sole country willing and able to stand up to Trump’s tactics and is managing to emerge relatively unscathed. Equities recovered quickly, but cryptocurrencies, driven more by sentiment than fundamentals, failed to regain their losses, possibly signalling that the dent is turning into a crack.

Staying with sentiment driven assets, gold also endured a volatile month. It began by breaking USD4,000 an ounce for the first time ever, just six months after surpassing USD3,000 and only six weeks after USD3,500, a clear sign of accelerating momentum. It touched near USD4,300 by mid-month, amid news of global queues waiting to buy gold coins and bars, and websites such as the Royal Mint struggling to keep up with demand. In the end, gold finished the month around USD4,000. Whether this represents a pause for breath or another example of market froth being purged remains to be seen.

The final major sign of market fragility in October was a handful of defaults in the private credit sector, mainly fraud‑related. Private lenders have supplanted traditional banks in large areas of the credit market, making financing more accessible for many companies, but the concern is that too much capital has gone to lower quality borrowers, and an economic downturn could trigger a sharper rise in defaults than expected. Thus far the defaults have been driven by fraud rather than indicative of broad economic distress and limited to specific sectors such as autos. Also, although private‐credit deals are less transparent than bank or public credit lending, they carry less systemic risk. Interestingly though, US banks reporting Q3 results showed a reduction in loan write-offs on their balance sheets suggesting we are not yet at a point of broad economic deterioration. It remains an important market to monitor, however, as it often acts as a canary in the coalmine.

On the macroeconomic front, with the US federal government shutdown entering its fourth week at month end, only inflation data was released at 3 %, which was below expectations. This opened the door for a rate cut by the US central bank, mindful of a weakening jobs market but it emphasised that future cuts are not guaranteed at future meetings. Markets expected the cut, and this helped support risk assets in the lead up to the meeting at month-end, despite earlier volatility. Equally, in the UK, weaker than expected inflation also boosted the chances of a rate cut by the Bank of England before year end to address anaemic growth. However, the looming UK Budget at the end of November introduces uncertainty: a sizeable fiscal hole may force the Chancellor to break manifesto tax pledges, and the Bank may opt for a pause until after the Budget. Europe continued to see headwinds, with political uncertainty in France and weak industrial production in Germany. Japan fared better after the appointment of a new prime minister, Sanae Takaichi, who promises market friendly fiscal stimulus and helped push Japanese equities to the top of the global leaderboard for the month and year-to-date.

At the company level, Artificial Intelligence (AI) remains the dominant theme and a flurry of deals between AI providers and critical component suppliers (chips, servers…) was announced. So far, investors are absorbing these announcements, helping drive Nvidia to an all-time record of USD5 trillion market capitalisation (roughly the size of the whole Japanese economy!). It is noteworthy, however, that market reaction to earnings reports from large tech companies is increasingly signalling a reluctance to support projects with low visibility of future earnings enhancements. This is another sign that high valuations are demanding greater selectivity.

Fund Performance

Wise Multi-Asset Growth

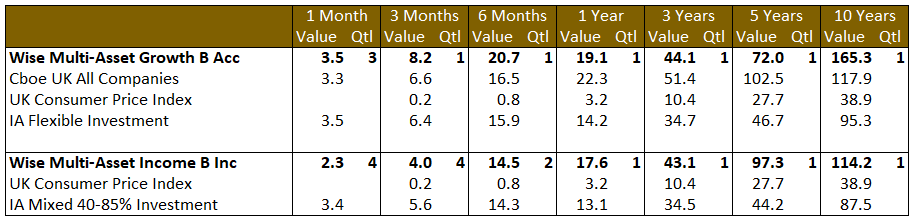

In October, the IFSL Wise Multi-Asset Growth Fund was up 3.5% ahead of the CBOE UK All Companies Index (+ 3.3%) and in line with its peer group, the IA Flexible Investment sector (+ 3.5%). In what feels like a period of transition where the economy is hard to read and investor sentiment shows signs of frailty, we are pleased that our more idiosyncratic ideas, driven by specific catalysts rather than macro factors, are performing well. Nearly half of our outperformance last month was driven by our healthcare investment trust holdings. Accelerated acquisition activity among biotechnology companies by large pharma continued to boost both International Biotechnology Trust and RTW Biotech Opportunities which held positions in companies (Akero and Avidity) acquired during the month (at premiums of 17 % and 46 % respectively). This takes the year’s total number of acquisitions in the International Biotechnology Trust portfolio to nine, and six in the RTW portfolio, signalling the potent combination of strong innovation, cheap valuations and acquisition urgency by large pharmaceutical companies needing to replenish their stocks of patents. Meanwhile, in private equity, ICG Enterprise announced another realisation at a premium — one of six in its top holdings this year — aiding its discount tightening. Our other private equity holdings saw similar moves in their discounts.

The primary detractors were in the mining sector, reflecting the volatility in precious metal prices.

Wise Multi-Asset Income

Against this backdrop, the IFSL Wise Multi-Asset Income Fund rose 2.3%, behind the IA Mixed Investment 40–85% sector, which gained 3.4%. Our equity funds performed well over the month, with Odyssean Investment Trust and Man Income Fund performing strongly despite their greater exposure to UK mid- and smaller-sized companies. Our specialist equity funds, International Biotechnology Trust and Ecofin Global Utilities & Infrastructure, were particularly strong performers. The biotechnology sector is emerging from an unusually long period of weak performance, not helped by politically induced concerns over tariffs and drug pricing. Deals from AstraZeneca and Pfizer around price reductions, tariffs and the onshoring of manufacturing to the US proved more positive than feared and helped lift sentiment across the sector. Biotech investors were then able to focus on a further wave of acquisitions by large-cap pharmaceutical companies seeking to replenish pipelines as blockbuster drugs come off patent. International Biotechnology Trust saw two more of its holdings—Akero Therapeutics and Avidity Biosciences—acquired at significant premiums, marking the eighth and ninth such transactions this year. Our private equity holdings also contributed positively, reflecting the buoyant environment for risk assets. ICG Enterprise reported a steady increase in net asset value and portfolio returns, supported by strong earnings growth and several major portfolio exits. With solid liquidity, ongoing share buybacks and a narrowing discount—helped by prudent balance sheet management and consistent realisations achieved at or above carrying value—investor confidence improved further through the month. Despite the favourable backdrop of lower government bond yields, our renewables holdings were weaker. Bluefield Solar announced that it had ended sale discussions and proposed an alternative route forward for the group, focusing on sustainable growth from building out its pipeline of solar projects, but at the cost of a reduced dividend. Despite clear value within the sector, the market took both pieces of news badly, weighing on performance.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

It was a busy month for portfolio activity. We exercised caution, taking profits in several strong performing positions, including Jupiter Gold & Silver earlier in the month. Following the surprise departure of its managers, we exited our position in the Schroder Emerging Markets Value Fund and replaced it with another value-oriented manager on our reserve list: Pacific North of South Emerging Markets Equity Income Opportunities. We also diversified our holding in the Schroder Global Recovery Fund by switching some exposure into the Brickwood Global Value Fund (run by managers we have previously invested with in their previous firm). We added a new position in the CVC Income & Growth trust, a loan manager known for due diligence discipline and a strong default-avoidance track record. Finally, we topped up Achilles Investment Company, an activist manager in the investment trust space, which we believe is well positioned to generate attractive returns despite uncertain macro conditions. Overall, our cash levels remained higher than average, leaving some powder dry to take advantage of future opportunities.

Wise Multi-Asset Income

October was a reasonably busy trading month for the fund. Within renewables, we switched our holding in Greencoat UK Wind into Foresight Environmental Infrastructure, a more diversified company with less debt and lower sensitivity to power prices and government subsidies. Following the departure of the managers, we also switched our holding in Schroder Emerging Market Value into Prusik Asian Equity Income and Pacific North of South Emerging Markets Equity Income Opportunities. The Aberdeen Asian Income holding was switched at the same time. We initiated holdings in CVC Income & Growth, which invests in senior secured loans and other corporate credit, and in Life Science REIT, a specialist property fund committed to selling its property holdings over the next 18 months. We also introduced Brickwood Global Value, a global equity fund, funded by a reduction in our Schroder Global Equity Income position. Elsewhere, we took profits in holdings that have performed strongly, such as Ecofin Global Utilities & Infrastructure, BlackRock World Mining, International Biotechnology Trust and ICG Enterprise, and recycled capital into names that have lagged. As such, we increased our exposure to Aberforth Smaller Companies, Helical, International Public Partnerships, Odyssean Investment Trust and Polar Capital Global Financials.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds. The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.