The following article was written by FE Trustnet with full details below

Multi-manager funds generally dominated the list of top-performing high-cost portfolios in the four main Investment Association (IA) multi-asset sectors over the past five years, Trustnet research has found.

With almost 600 funds to choose from, some investors may choose low-costs options as charges are one of the biggest detriments to returns. However, costs aren’t everything and some funds that charge more have made exceptional returns despite higher fees.

As part of an ongoing series, Trustnet examines the funds in each sector that have posted top-quartile returns over the past five years, with relatively expensive ongoing charges figures (OCF) of above 1%. Today, we examine the four main multi-asset sectors.

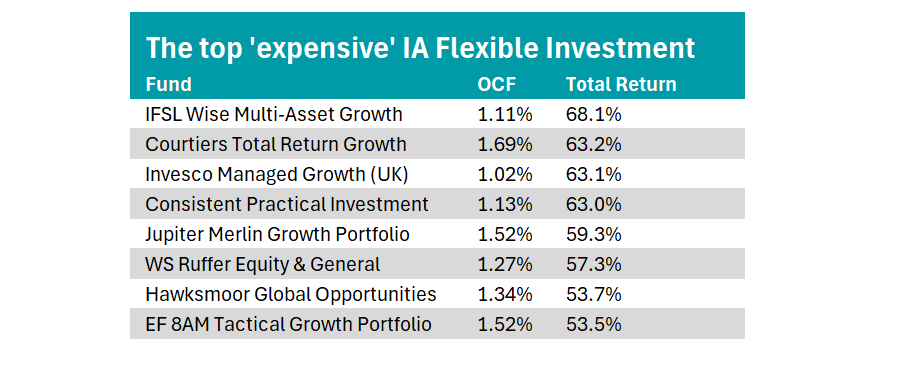

IA Flexible Investment

In the IA Flexible sector, where managers are completely unconstrained, IFSL Wise Multi-Asset Growth fund took the crown for best performance with a total return of 68.1% after deducting its 1.11% OCF.

Source: FE Analytics

Led by Vincent Ropers and Phillip Matthews, it is a multi-manager approach that buys funds and trusts in “out of favour areas” to generate growth.

Around 50% of the portfolio is allocated towards stocks, followed by alternatives at 33.3% and 8.3% in bonds. Its top holding is the Worldwide Healthcare Trust followed by smaller companies specialist Odyssean and healthcare trust International Biotechnology, which make up the top three positions.

The allocation to alternatives has been a strong contributor to the fund so far this year, with holdings such as Jupiter Gold and Silver benefiting from the rally in the precious metal.

For investors who may prefer the safety of a larger team and fund, the £1.7bn Jupiter Merlin Growth Portfolio also appeared on the list.

Led by FE fundinfo Alpha Manager John Chatfeild-Roberts and his team, it is another fund of funds strategy with around 10-20 holdings in other portfolios.

Analysts at Titan Square Mile, which has awarded the fund with an ‘AA’ rating, said it is a significantly different portfolio to many competitors, due to the team’s “common-sense” approach, leading them to avoid more complex forms of investment.

This approach has resulted in a 59.3% five-year return after fees, despite a 1.52% OCF.

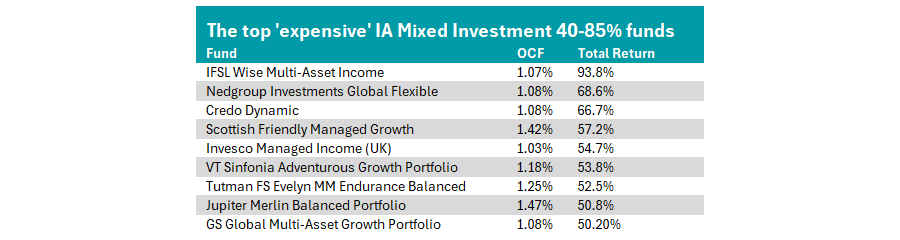

IA Mixed Investment 40-85% Shares

In the highest banded equity sector, investors had nine options in the IA Mixed Investment 40-85% shares sector that combined an OCF of above 1% with a top-quartile performance after fees.

Source: FE Analytics

Another multi-manager fund from the team at Wise Funds outperformed in this sector, with the IFSL Wise Multi-Asset Income fund up 93.8%, despite an ongoing charge of 1.07%.

This portfolio is less equity-heavy than its stablemate, with just 35% in stocks and a much greater allocation towards fixed interest and property. This allocations means it falls below the sector’s minimum equity exposure, but may still qualify given its preference for investment trusts, which could count towards an equity allocation despite investing in alternative assets.

FundCalibre, which added the strategy to its Elite Radar earlier this year, said: “We like the team’s straightforward process and focus on managers with a simple, yet disciplined investment approach.”

Analysts praised the managers’ willingness to use investment trusts to “tap into value opportunities” in regions or sectors considered unfashionable. However, they noted that the emphasis on out-of-favour areas can cause performance to take longer to come through.

Other top options in the sector include Nedgroup Investments Global Flexible, Credo Dynamic and Jupiter Merlin Balanced.

To read more, please follow the link below

The expensive multi-asset funds that justified their costs | Trustnet

The information within this post was written by FE Trustnet and not on behalf of Wise Funds. All data is their own.