For Professional Clients Only

Macro & Market Update

Interest rates have now stayed on hold for over 10 months in the US, over 9 months in the UK and over 8 months in the Eurozone. Markets generally believe that the tightening cycle of monetary policy is now behind us and the next move in interest rates will be down. The question remains how many more months will rates stay on hold, which of these three central banks is likely to cut rates first, and by how much can rates be cut without re-igniting the inflationary forces that so much effort has been exerted to tame. Whilst changes in interest rates most directly impact bond markets, movements up and down in the cost of money are also keenly observed by equity investors as they both influence future expectations around economic growth and consequently corporate earnings as well as the rate those future earnings are discounted back to today to derive fair estimates of value. Data highlighting changes to economic growth and inflation continue to be carefully studied as a result in order to provide answers to the questions above. Over the month, investors drew some comfort that recent unhelpful inflation data in the US was no longer coming in stronger than expected. This reinforced more positive news previously released that showed the US labour market was finally showing some signs of cooling. Whilst this provided the Federal Reserve (Fed) with some welcome breathing space, comments from the chairman, Jerome Powell, at the start of the month citing a lack of further progress towards its 2% target in recent months, caused investors to conclude the US is not likely to be the first major central bank to cut rates. Conversely, the European Central Bank buoyed by more benign recent inflation data stoked expectations that it will lower its benchmark deposit rate as early as its next meeting in the first week in June. Rather than being led by the Fed they are happy to branch out alone if that is what the data allows. In the UK, the Bank of England (BOE) signalled it would cut rates this summer, possibly by more than was priced into markets at the time, even though subsequently reported UK inflation dropped by less than expected and GDP data for the first quarter showed the UK economy had grown by the fastest pace since 2021. Whilst markets have been focussed on economic data and monetary policy in recent months, May provided something of a political surprise in the UK with Rishi Sunak electing to hold a July General Election rather than in the autumn as expected. Markets saw limited direct impact from the announcement and appear to believe that a change in government is the most probable outcome and with it, greater political clarity. In the US, Donald Trump was found guilty of falsifying business records although this appears only to have polarised further US political divisions rather than denting his electoral chances.

Equity markets performed strongly over the month helped by the more supportive US inflation and employment data. In the UK, cheap equity market valuations coupled with signs that the economy is recovering from the weakness experienced during the second half of last year, the BOE poised to cut interest rates and a steady trickle of bid activity for UK companies provided a solid backdrop for healthy UK equity market returns, particularly for mid and small-sized companies.

Fund Performance

Wise Multi-Asset Growth

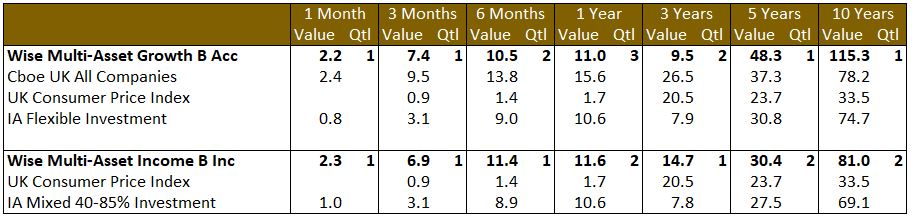

In May, the IFSL Wise Multi-Asset Growth Fund was up 2.2%, slightly behind the CBOE UK All Companies Index (+2.4%) but ahead of its peer group, the IA Flexible Investment Sector (+0.8%). Similarly to last month, our UK equity managers continued to be strong contributors to our performance, helped, in part, by the strong M&A activity discussed earlier. Our strongest contributor, Odyssean, saw its 4th largest holding XP Power (~9% of the portfolio) receive its 3rd takeover proposal since October, at a 68% premium to its share price. The board still believe this undervalues the company and have rejected it, highlighting how much value is embedded in many UK-listed stocks. Another sector where M&A activity is accelerating, driven by cheap valuations, is the biotechnology sector. In that space, International Biotechnology Trust have received some 23 bids for holdings in their portfolio since 2020 and benefitted from an uplift of almost 3% to its Net Asset Value at the end of the month when it sold one of its private ophthalmology biotech holding to the large healthcare company Merck. It is worth noting that none of our managers invest assuming take-overs will take place but, when valuations are driven too cheap because of listed markets investors’ lack of interest, M&A is a helpful mechanism to realise (or at least highlight) value.

Another way for value to be extracted and returned to shareholders is for companies to buy their shares back. This also happens in investment trusts as a means of reducing their discount and/or showing the managers’ conviction in their portfolio (i.e. the managers find more value in their own shares than in other investments they could make on behalf of their investors). Illustrating the point we have made for months with regards to the cheapness of the investment trusts sector currently, it was reported last month that the number of trusts which have bought their shares back hit a monthly record since 1996. When corporates are reinvesting in their own shares or acquiring competitors, investors should pay attention.

Wise Multi-Asset Income

In May, the IFSL Wise Multi-Asset Income Fund rose 2.3%, ahead of the IA Mixed Investment 40-85% Sector, which rose 1%. Our equity holdings were the strongest contributors to performance over the month with the UK holdings leading the way. Our UK fund holdings Aberforth Smaller Companies, Fidelity Special Values and GLG Income all outperformed the broader UK market as did our two direct financial holdings, Paragon and Legal & General. Last month we said that an average discount of over 30% on our property holdings coupled with a positive outlook for rental growth should provide a significant margin of safety in the face of higher interest rates. This month property was again a positive contributor to returns. Over the month, Empiric Student Property announced it expected growth in average weekly rents to exceed 6% for the upcoming academic year on the back of full occupancy of its rooms whilst Impact Healthcare REIT announced 4% rental growth, with care home tenant performance continuing to improve driven by stable bed occupancy and rising fees. Abrdn Property Income confirmed shareholder approval for the managed wind-down of its portfolio as well as an updated net asset value nearly 50% higher than the prevailing share price. Helical announced the sale of 50% stake in its 100 New Bridge Street development coupled with the signing of a financing package and building contract that paves the way for the redevelopment of this office block to be completed in March 2026. Whilst the half-year results saw a greater than expected 33% net asset value fall given the weakness in the office sector, the shares again appear to more than reflect this sitting at a greater than 30% discount to the revised asset value.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Over the month, we added to our position in biotechnology via RTW Biotech Opportunities and International Biotechnology Trust (prior to the announcement mentioned above). This was financed by profit taking across a number of global and regional equity holdings, as well as defensive strategies, including Jupiter Gold & Silver, up more than 40% in the past 3 months. Whilst we believe there could be more upside in precious metals miners from here, we acknowledge it is unlikely to come in a straight line, hence the desire to lock some profits in.

Wise Multi-Asset Income

Over the month, we added to our holding in GCP Infrastructure following a positive meeting with the manager and a visit to one of their Energy from Waste investments in Gloucestershire. The board is committed to realise £150m of assets over the next year (15% of the portfolio) and to pay down debt and buy back £50m of shares. A recently announced disposal of a windfarm above book value is a good start and demonstrates the renewed focus away from investments with exposure to unpredictable generation output and power prices. With the shares sitting at a near 30% discount to asset value, yielding over 9% and a commitment to improve capital allocation, we believe this represents an attractive opportunity. We switched some of our holding in International Public Partnerships into HICL Infrastructure given recent relative share price performance. Similarly, we trimmed a number of our better performing equity holdings and added to ICG Enterprise, a private equity fund which has lagged in recent months.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.