Wise Multi-Asset Growth

Fund Ratings

Investment Objective

The investment objective of the Fund is to provide capital growth over Rolling Periods of 5 years in excess of the Cboe UK All Companies Index and in line with or in excess of the Consumer Price Index, in each case after charges.

Fund Attributes

- Aims to provide long term capital growth (over 5 year rolling periods) ahead of the Cboe UK All Companies Index and inflation.

- Specialised focus on investment trusts across asset classes.

- Adopts a value bias investment approach.

- Focus on high-quality funds and investment trusts investing in out-of- favour areas.

- Preference for fund managers with a disciplined, easy-to-understand investment process.

Investor Profile

- Seek capital growth over a long time frame.

- Accept the risks associated with the volatile nature of an adventurous multi-asset investment.

- Plan to hold their investment for the long term, 5 years or more.

Key Details

| Target Benchmark | Cboe UK All Companies, UK CPI |

|---|---|

| Comparator Benchmark (Sector) | IA Flexible Investment |

| Launch date | 1st April 2004 |

| Fund value | 68.7 million |

| Holdings | 41 |

| Valuation time | 12pm |

- Past performance is not a guide to the future

- Data as at 31st January 2026

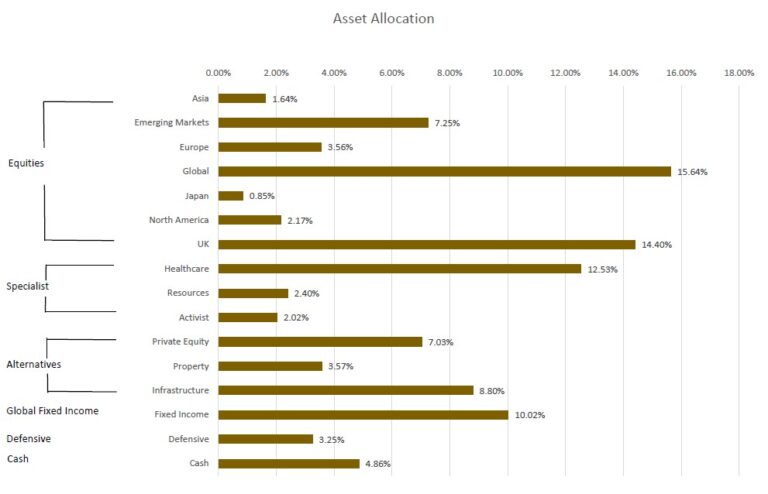

Investment Portfolio - January 2026

- Past performance is not a guide to the future

- Data as at 31st January 2026

Share Class Information

| | B Acc (Clean) | W Acc (Institutional) |

|---|---|---|

| Sedol Codes | 3427253 | BD386X6 |

| ISIN Codes | GB0034272533 | GB00BD386X65 |

| Minimum Lump Sum | £1,000 | £100 million |

| Initial Charge | 0% | 0% |

| IFA Legacy Trail Commission | Nil | Nil |

| Investment Management Fee | 0.75% | 0.50% |

| Operational Costs | 0.14% | 0.14% |

| Fund Management Costs | 0.22% | 0.22% |

| Ongoing Charges Figure 12 | 1.11% | 0.86% |

All performance is still quoted net of fees.

- The Ongoing Charges Figure is based on the expenses incurred by the fund for the period ended 30th August 2025 as per the UCITS rules.

- Includes Investment Management Fee, Operational costs and look-through costs.

The figures may vary year to year

Fund Commentary - January 2026

Geopolitics dominated the news flow in January with developments that could reshape the global order established after WWII. The year began with the unexpected capture and removal of President Maduro in Venezuela by US military forces. President Trump then declared that the US would govern and reform the country. Although Maduro was widely seen as illegitimate, this direct intervention by a foreign power raised legal questions and made other countries uneasy. This was overshadowed by rising tensions between Trump and European countries over Greenland.

These tensions led to tariff threats between the US and the EU, unusually strong public arguments between allied leaders, and concerns about the possible weakening of NATO, the military alliance of European and North American countries that has ensured the security of its members for nearly 80 years. After strong resistance from international partners, Trump seemed to back down towards the end of the month. However, such aggressive behaviour from a NATO member may encourage other Western countries to reduce their dependence on the US, both militarily and economically. It is therefore notable that both Prime Minister Carney of Canada and Prime Minister Starmer of the UK made official visits to China for the first time in about eight years to discuss possible trade agreements. Finally, geopolitically, the month ended with the US showing military strength in the Middle East and issuing threats against Iran following deadly protests.

Events were also lively on the US domestic front, reinforcing the idea that President Trump is eager to generate news, possibly to distract from his lower approval ratings before the midterm elections this autumn. The key financial markets story was the threat of criminal charges against Jerome Powell, chair of the Federal Reserve (or the Fed, the US central bank). Trump’s public criticism of Powell’s reluctance to cut interest rates aggressively made the threat seem like a direct challenge to the Fed’s independence. This came at a time when Powell’s term as Fed chair is ending in June, allowing Trump to appoint a successor. Strong pushback from market participants appears to have led Trump to nominate a more credible and moderate candidate, instead of earlier picks that would have seemed less independent. While attacks on a key pillar of financial stability helped gold and silver post some of their best weeks on record, the appointment of a sensible candidate at month end caused these safe haven assets to fall sharply as the US dollar regained some ground. ‑

With so much focus on the events above, regular monthly economic data were less in the spotlight. Notably, US GDP growth is expected to be the strongest in a decade, and inflation remained stable but still high. This led the Fed to keep interest rates unchanged and signal no rush to cut them. However, US consumer confidence fell to its lowest level since 2014, which may pressure Trump to introduce measures aimed at boosting consumer support before the mid‑term elections. In the UK, GDP growth was stronger than expected, and inflation also rose despite slower wage growth. This leaves the Bank of England uncertain about future interest rate decisions. Finally, in Japan, Prime Minister Takaichi called a snap general election to take advantage of high approval ratings. Her emphasis on large stimulus measures raised concerns in Japanese bond and currency markets.

Despite the risk of market overload in a very busy month, so-called risk assets (equities, bonds, and commodities) performed well overall, with international markets, especially emerging markets, outperforming the US. A weaker US dollar often helps these markets, and concerns about fiscal deficits in developed countries make emerging markets look more attractive. The ongoing theme of artificial intelligence (AI) also benefits leading companies in South Korea, Taiwan, and China. As noted earlier, precious metals saw dramatic gains in January, but they became vulnerable late in the month as it became clear an increasing portion of the buying was financed by debt leading to accentuated selling when prices turn. Consequently, volatility reached its highest level in more than a decade.

In January, the IFSL Wise Multi-Asset Growth Fund was up 2.3%, behind the CBOE UK All Companies Index (+2.8%) but ahead of its peer group, the IA Flexible Investment sector (+1.8%). With gold up around 25% and silver up around 65% for the month at their peaks, it is no surprise that our top two contributors were the Jupiter Gold & Silver and BlackRock World Mining. Other strong contributors were in UK smaller companies (Odyssean and Aberforth Smaller Companies) where trading updates have generally been positive and corporate activity remains supportive. Our positions in emerging markets, namely Pacific North of South Emerging Markets Equity Income and Templeton Emerging Markets, also contributed positively. The key detractors were healthcare holdings (International Biotechnology, RTW Biotech Opportunities, Worldwide Healthcare), where recent positive sentiment weakened. It was encouraging though to see RTW Biotech Opportunities participating both in the first IPO (Initial Public Offering, i.e. when a private company goes public) and the first major acquisition of the year, each at significant premiums to previously reported prices. In private equity, Oakley Capital’s discount widened and detracted from performance.

In terms of portfolio activity, our main focus remained on caution and taking profits by trimming positions in Jupiter Gold & Silver and BlackRock World Mining, which we have done consistently for the past 12-18 months. This helped keep our cash balance above its historical average (around 5%), ready to deploy during market weakness. We also increased our bond holdings in the TwentyFour Strategic Income and Premier Miton Strategic Monthly Income Bond funds. Additionally, we added to weaker positions in Mobius, Pershing Square, and HICL Infrastructure.